At the end of a week of sales dedicated to the impressive Rockefeller collection (cf. the Report) in which the first night of auctions alone brought in 646 million dollars and record prices for Monet, Matisse, Corot, Delacroix, Morandi and Redon, it’s clear that a substantial number of the richest people on the planet, from Beijing to New York, are interested in following a trend and looking to favourably invest their money in modern and contemporary art.

And yet there were some observers during the Rockefeller modern auction, like the private Swiss dealer Thomas Seydoux, who noticed: “the lack of enthusiasm in the room despite the exceptional prices. The works were guaranteed (1). To insiders’ eyes, the die had already been cast well before the sale”.

However, it may transpire that the next round of auctions held next week in New York will produce some spectacular results. If we limit ourselves to the evening sales (the most important sales in terms of quality and estimates), they begin on 14 May with the modern art sale at Sotheby’s and end on 17 May with the contemporary art sale at Christie’s.

Modigliani

Without doubt this week’s undisputed star is a painting by Amedeo Modigliani, the largest nude painting the artist ever made (measuring 146.7cm in length). Dating from 1917, it was exhibited last year as part of the remarkable Modigliani retrospective at the Tate Modern gallery in London (cf the report).

This painting is estimated by Sotheby’s at 150 million dollars; the highest estimate ever given to an artwork at auction and most probably the largest guarantee ever given as well. The work was sold in 2003 for 26.8 million dollars. In 2015 Christie’s sold another nude, smaller in size but also more sensual in nature, for the record price of 170.4 million dollars. It was acquired by Wang Wei and her husband, owners of the Long Museum, a private museum in Shanghai that evidently comprises a group of Chinese investors.

Picasso

For Thomas Seydoux, one of the most remarkable works of the season is a painting by Pablo Picasso made during the war in 1943.

The painting is believed to be a self-portrait in which Pablo depicts himself with his face contorted, dressed as a sailor, with his legs crossed over as though trapped in a box. The painting is estimated at 70 million dollars by Christie’s. For a long time it belonged to the legendary New York collectors Victor and Sally Ganz and it was sold in 1997 for 8.8 million dollars. No less than 22 Picassos are to be presented at Christie’s and Sotheby’s as part of the evening sales.

Malevich

The arrival of a Kasimir Malevich at auction is always a big event. He was the founder of Suprematism, one of the most radical movements of the early 20th century, which presents colourful geometric shapes as though moving through space. According to the Artprice database, only 15 paintings by the Russian artist have gone on sale since 1987. The record price was obtained in 2008 for a colourful suprematist composition painted in 1919, sold at auction for 60 million dollars. It emerged that it was acquired by the family of dealers from New York and London, the Nahmads, for they exhibited it in their new gallery in London in 2011. They are putting it up for sale again at Christie’s with an estimate of 70 million dollars.

Basquiat

The American artist Jean-Michel Basquiat, who died at the age of 27, has over time, and also thanks to the art market, achieved iconic status in contemporary art, becoming a kind of rock star. In May 2017 Sotheby’s sold one of his 1982 canvases at auction for 110.4 million dollars to the Japanese billionaire Yusaka Maezawa. This work will incidentally feature in the Basquiat retrospective organized by the Vuitton foundation in Paris in October, or so I have been informed by Maezawa himself.

On 16 May Sotheby’s is again presenting a painting composed of two panels from 1982-83 measuring 3.7×3.7 metres in total. It is estimated at 30 million dollars. Christie’s has a weaker offering on the subject on 17 May with a painting of a “Red Rabbit” from 1982, which looks as though it’s been electrocuted. Estimated today at 5 million dollars, it was sold in 1993 in the midst of the art market crisis for 52 500 dollars. As for Phillips auction house, also on 17 May as part of its contemporary sale it is presenting an artwork that conveys the spirit of Basquiat in a nutshell: “Flexible”, depicting a cadaverous figure from 1984 which originates from the artist’s estate. Estimate: 20 million dollars.

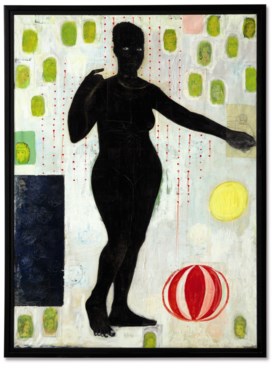

Kerry James Marshall

He is a major painter (born in 1955) who addresses the subject of black people in contemporary American society. Marshall created a distinctive figurative style, luxuriant and highly colourful, peopled with completely black figures. The word black is often used to mean brown, but Marshall paints his figures dark black. They stop being people to become shadows. Kerry James Marshall speaks about the “invisibility” of black people. Since his retrospective in 2016 and 2017, (cf the Report) which toured from New York at the Met Breuer to Chicago and Los Angeles, the artist has become even more high-profile.

On 16 May Sotheby’s is presenting one of his remarkable paintings from 1997, which featured in the American retrospective. “Past Times” is a large genre painting depicting a picnic scene set against a colourful background. Estimate: 8 million dollars. His record price up until now has been held by a small yet important painting sold at auction in 2017 for 5 million dollars. The head of contemporary art at Sotheby’s in New York, Grégoire Billault, explains how he set the bold estimate price for this artwork.

Christie’s is also presenting their own Kerry James Marshall work, a female nude from 1991 (estimate: 2 million dollars) and so is Phillips, with a composition depicting a couple having a siesta, “Untitled (Blanket Couple)” dating from 2014. Estimate: 3.5 million dollars.

Mark Bradford

He’s the artist (born in 1961) who has attracted the most interest from the art market over the past few months, partly because he represented the United States at the last Venice Biennale, but also because his gallery, the ultra-powerful Hauser & Wirth, has bet a lot on him. (see the interview of Ivan Wirth about Badford)

He was the subject of an exhibition at the beginning of the year at their exhibition space in Los Angeles, then again during the Art Basel Hong Kong fair at their new premises in Hong Kong. Among the buyers we noted the Japanese billionaire who bought the record price Basquiat piece, Maezawa, but also the Long Museum in Shanghai who bought the record Modigliani in 2015.

This means that he’s an artist who’s “hot” right now.

This March one of his characteristic but very large-scale artworks, made from layering many materials in an aesthetically appealing way, which belonged to the tennis player John McEnroe, was acquired for the record price of 12 million dollars by the Los Angeles billionaire Eli Broad, who founded the eponymous museum in his city. This is the same Eli Broad who put another Bradford canvas up for sale at Christie’s on 17 May, a smaller painting from 2007 entitled “Boreas” estimated at 5 million dollars.

Phillips is presenting a painting by Bradford from 2005 estimated at 5 million dollars and Sotheby’s has no less than two of his paintings, one of which has just been finished having been made especially for a charity sale whose profits are to go to the Studio Museum in Harlem (estimate: 2 million dollars) and another from 2014 estimated at 4 million dollars. For Robert Manley from Phillips, this massive influx of Bradford’s paintings into the market should summon caution in the context of a recent powerful rise in his value. “That’s why I only have accepted one of his works in our sale,” he explains.

In the area of contemporary art, this season Christie’s is presenting a sale estimated at 320 million dollars, Sotheby’s at 210 million plus the Mandel collection mixing modern and contemporary art valued at 72.9 million, while Phillips is anticipating 117 million dollars.

A policy has been practised for several years now seeking to give estimates for artworks at sums clearly well above those already obtained. But isn’t this dangerous? To what extent are the auction houses willing to push up prices while simultaneously having these huge sums guaranteed by third parties?

(1) The transaction has a guaranteed price agreed upon by a third party, generally up to the lowest estimate.

Donating=Supporting

Support independent news on art.

Your contribution : Make a monthly commitment to support JBH Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.