30 years old

He’s thirty years old and he’s in a hurry. It’s been scarcely six months since NFTs were created and already Justin Sun, the Hong Kong-based Chinese founder of the cryptocurrency platform Tron, states in an exclusive interview that over the next 12 months he plans to invest no less than 100 million dollars in NFT art and art in general.

NFT and big names

Beeple

He explains his objectives, which are very rational, and his relationship with art. He wants to combine the NFT identity with big names in the art world.

Blockchain writing

NFTs, which stands for ‘non-fungible tokens’, are a form of blockchain writing that allows for a unique and secure inscription which can communicate permanent and inviolable information. What’s interesting about them, for the moment, is the fact that they can be linked to the file type (jpeg, for example) of video or digital works. But in the future NFTs may also be associated with real-life artworks. All this is evidently being tackled by the high-profile young Chinese entrepreneur. He made headlines in 2019 when he paid 4.6 million dollars at auction for a dinner with Warren Buffet.

Record price

Pablo Picasso

At Christie’s on 11 March 2021, a digital artwork composed of 5000 images made by Beeple, encrypted in the NFT format, was bought by a tech entrepreneur of Indian origin who lives in Singapore, Vignesh Sundaresan. (See the report about NFT here)

Beeple and Picasso

Andy Warhol

The underbidder of this record sum, which had a seismic media impact, was Justin Sun. After the sale, he said that a system glitch had prevented him from bidding more. Clearly frustrated, shortly afterwards he bought another NFT by Beeple, “Ocean Front”, for 6 million dollars. But then, to widespread surprise, ten days after the record sale at Christie’s Justin Sun acquired a little canvas by Picasso for 20 million dollars from the legendary year in the artist’s production, 1932, at a modern art auction in London. (See the report about Picasso in 1932 here)

The interview

He explains how he envisages the next stage of his forays into the art world. Here is a summary of his interview, which you can also watch in video format.

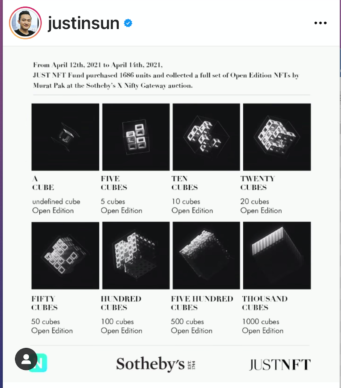

– You created a fund called “Just NFT”. What is it for?

It’s a fund that is focused on investing in NFT art and traditional art. We want to build a bridge between the two disciplines. Right now I am the main investor. Others are due to follow. We don’t intend to sell the artworks at the moment. That will depend on the market.

– You recently bought a Picasso painting from 1932 for 20 million dollars. Is this your first traditional art purchase? What will you do with it?

Indeed. We will put it in a safe in Hong Kong. I think the majority of our artworks will be safeguarded in this way. And when we have a suitable place we will be able to publicly exhibit these artworks.

– Have you ever lived alongside works of art?

When I was in the United States (ed. Justin Sun studied at the University of Pennsylvania in Philadelphia) I attended many classes on art. There aren’t many Asians who collect western art. That won’t be the case for us. In New York I visited Moma, in London the Tate. In Shanghai one of my friends has a private museum. I’m interested in traditional art because I think it has a real value. I want to act as the bridge between traditional art and the world of blockchain.

– Does that mean that bitcoin doesn’t have a real value?

The function of bitcoin is not to be a real currency on the model of the euro or the dollar. Instead you could compare it to silver or gold, it’s like a sort of digital gold. But here we’re doing a lot more than bitcoin. Tron follows a blockchain protocol. Traditional art and NFTs will be part of our activities. We’d like for traditional artists and NFT artists to migrate towards blockchain.

– Can traditional art help to inspire confidence in blockchain? Why do you communicate around each of your acquisitions?

Yes. I think it’s important to be open and transparent. Everyone can see our collection. We want all art to be available over blockchain. Because blockchain also deals in transparency. We will be able to share it online with the whole world. We want to made Picassos and Monets accessible to the public, unlike the artworks that are in private collections.

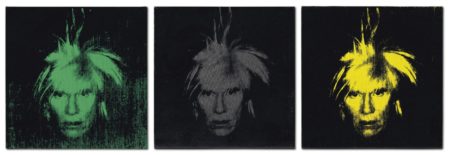

– Who advises you in your art purchases?

Sotheby’s and Christie’s have created lists of artworks that we are able to buy. We have also set up a team of people who were previously employed by the auction houses. In the future we will recruit people to oversee acquisitions and research on the works in advance. For now, we are focusing on artists listed at the top of the Artprice database: Picasso, Andy Warhol, Basquiat. We didn’t buy Basquiat’s “Warrior” recently because the estimate was too high, 30 to 40 million dollars (1).

– What do you think of the artistic quality of Beeple?

Beeple together with Pak are the NFT artists in which we are investing massively. Beeple still has some way to go in being recognized by the traditional art industry. In the field of NFTs there is a database that lists the most sold artists (https://cryptoart.io/artists). It says that Beeple ranks first and Pak is second in terms of volume of sales. They both have excellent relationships with NFT platforms like Christie’s, Sotheby’s and Nifty Gateway. Their art corresponds to the appetite of crypto-collectors, particularly millennials.

– Your criteria for selecting artists are based on the money that the artists can bring and their popularity, not their intrinsic quality. Isn’t that limiting?

Traditional art already has a long history that enables the value of things to be set. For NFTs, we will be investing in other artists, that’s for sure, but as you know NFT art has only been in existence for six months so far. We need time to develop quality standards. We also need galleries and criticism that will accompany them for the public before we are able to talk about the NFT art industry.

– But you didn’t hesitate to invest at least 69 million dollars in an industry that is only 6 months old?

Beeple is the first to emerge in this very recent context. The cryptocurrency industry has increased in volume in very considerable proportions. Some of the crypto-investors are turning towards the world of crypto-art. I liken this to the early days of the art market in the 17th century in Holland. Nobody knows how the market will evolve. For now, the prices are very volatile.

– You said there was a technical issue during the Beeple sale at Christie’s. How prepared were you to invest in the record piece?

I was prepared to go up to 80 million dollars. The system didn’t accept my last bid. I later bought another Beeple piece, “Ocean Front”, for 6 million dollars.

– What is your budget for the next 12 months?

We have a budget of around 100 million dollars dedicated to buying traditional art and NFTs.

– What is your next objective?

We would like to buy a Monet. Priority is given to the classic artists. A London landscape, “Waterloo Bridge”, and the “Waterlilies” are coming up on the market.

– If you buy a Monet can you create an NFT identity that will be linked to it?

Yes, that’s exactly what we are in the process of doing. We are working on it. The 1932 Picasso that we just bought will have an NFT identity soon.

(1) It was sold at Christie’s in Hong Kong for 41.7 million dollars on 23 March 2021.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.