Death

Who wants to part with their masterpieces? No one. That’s why the biggest art market records, generally obtained for absolutely outstanding works, are the fruit of forced and unhappy circumstances: death and divorce. This is primarily the way in which the rarest pieces in a collection are released back into circulation.

Cascade of records

This season of sales in New York has been defined by a cascade of records at auction linked to these “circumstantial” elements.

They are brought about by the competition between experienced, passionate collectors who have unusually substantial means at their disposal. According to the New York dealer Brett Gorvy, the former head of contemporary art at Christie’s, there’s scarcely a dozen of them in the world going to these auctions who kicked off the season at 20 million dollars. “These very elevated prices are the fruit of an impulsiveness and a certain madness,” he comments. “These are people who have the largest collections in the world and who really understand the idea of the absolute masterpiece.”

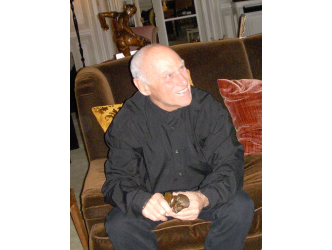

S.I Newhouse

Returning to the circumstances of the star lots of the season being put up for sale, on 1 October 2017 S. I. Newhouse, the businessman and owner of the Condé Nast group (Vogue, Vanity Fair…) among others, a prominent New York figure, passed away. It is the former head of contemporary art at Sotheby’s, Tobias Meyer, now turned private dealer, who the family has put in charge of the collection. Few people know the art market as well as he does, and he handed over eleven works to the Christie’s sale, including a Cézanne and a Koons estimated at 130 million dollars in total.

Jeff Koons

Jeff Koons’s Rabbit alone took 91 million dollars against an estimate of 50 million. The three other existing copies in polished stainless steel depicting an inflatable rabbit holding a carrot belong to Eli Broad’s museum in Los Angeles, the Museum of Contemporary Art Chicago and the national collections in Qatar. Which gives you a sense of how desirable it is. This rabbit is a decadent and fascinating revisited version of Brancusi’s ultra-smooth sculptures. It’s also, if it were necessary to be even more of the moment, clearly a sexual object. It was bought by Newhouse in 1992 from Larry Gagosian apparently for 1 million dollars. The rabbit is pictured on the cover of the catalogue for the Koons retrospective in Paris. The previous record for the American artist was set at 58.4 million dollars. Rumours are circulating over the identity of the buyer. There is talk of the New York hedge fund owner Steve Cohen, or the couple who opened the Glenstone foundation near Washington, collectors Emily and Mitchell Rales (see the report on the Glenstone collection).

The Swiss dealer Marc Blondeau points out that today, for the price of this “Rabbit”, you could acquire a Modigliani sculpture as well as a Brancusi sculpture. The art market without doubt remains unjust when it comes to art history.

Paul Cézanne

While we’re talking about art history we could mention the beautiful still life by Cézanne which is part of the Newhouse collection, estimated at 40 million dollars. (See the report announcing the modern art sales.) However, it presented a significant handicap: for a long time it had been presented in vain on the market in private transactions at 60 million dollars. This is pretty much the price that it attained (59.2 million dollars) on 13 May at Christie’s.

Claude Monet

Still within the range of works that have definitively gone down in art history we cannot fail to cite the haystacks under the setting sun painted by Claude Monet in fiery hues, which obtained the highest sum of the season at Sotheby’s and the record price for the artist: 110.7 million dollars. According to the British daily newspaper The Telegraph, the painting belonged to the Canadian engineer Thomas Beck. He died in 2016, having acquired it in 1986 for 2.5 million dollars.

Of the 25 versions in the “Haystacks” series, these are considered to be some of the most beautiful and 17 of them are now in museums. (See the report announcing the modern art sales). The private dealer Thomas Seydoux displayed strong enthusiasm following the sale: “It’s a truly sublime painting. It provoked a serious battle at auction, the likes of which we haven’t seen for a long time. Its status as flagship work of the season no doubt contributed to its rise in price”. Among the potential buyers the name of the collector and businessman Hasso Plattner from Potsdam has come up several times in industry circles.

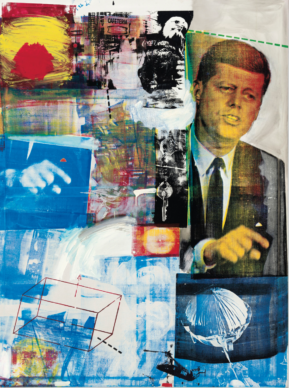

Robert Rauschenberg

In the pantheon of prices exceeding 50 million dollars there was not yet a place for the American artist Robert Rauschenberg (1925-2008). Up until now the record price for this remarkable painter and “sculptor” was set at 18.6 million dollars for a canvas of a relatively ascetic style from 1961. But on 13 May the hammer came down at Christie’s at 88.8 million dollars for a spectacular large-scale painting (244x184cm) by the artist dated from 1964, composed of an ensemble of images with John Fitzgerald Kennedy as the main figure. It belonged to the great Pop art enthusiasts from Chicago, Robert and Beatrice Mayer. The latter died at the age of 97 in September 2018.

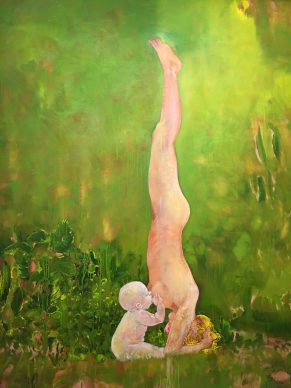

Balthus

In 1962, Dorothy Sherwood, one of the cultural figures of Beverly Hills, acquired a Balthus painting together with her husband Richard which has become one of the iconic works in the Franco-Swiss artist’s oeuvre, and was featured on the cover of the catalogue of the exhibition at the Metropolitan Museum in 2013. She died on 8 November 2018. On 13 May 2019, this painting of “Thérèse sur une banquette” (Thérèse on a bench seat), depicting a young girl wearing white socks and a short skirt in an acrobatic pose, was sold at Christie’s for the record price of 19.02 million dollars, which is 10 million more than the previous record. “Balthus only produced 350 paintings and this work from the late 1930s is particularly rare,” concludes Jean-Olivier Despres, who has staged various exhibitions of the artist’s work at the Gagosian gallery.

William Bouguereau

Lastly, among the bitter failures of the season we observe that the monumental composition by the “pompier” artist William Bouguereau estimated at 25 million dollars did not find a buyer at Sotheby’s. It should be noted that his previous record was 3.5 million dollars.

Ultimately, the art market also shows a degree of sense when it comes to the amount of money to spend. Because Bouguereau is not a part of the zeitgeist now.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.