Brave face

Sotheby’s

It’s rare that Sotheby’s and Christie’s have interests that coincide. But during these times of acute uncertainty, as wars rage from Eastern Europe to the Middle East, environmental challenges shake the planet – Extinction Rebellion activists stormed an auction for the first time on 11 November in New York – and the economy is damaged, their objectives are aligned. They involve putting on a brave face at all costs on the occasion of their modern and contemporary art sales in New York.

Global trend

Since these are the auctions that will set the global trend for sales over the coming months. They have a direct influence on the behaviour of art consumers. In recent years, the New York sales in May and November have acquired a very impressive scope in terms of financial matters, exceeding a billion dollars in sales. So they are the subject of numerous strategies and talks -such as the lowering of estimates until the last minute before going to auction- that can make a serious reading of the results quite complex.

Record prices

It’s clear that the ultimate aim of auction houses is to maintain confidence. Generally speaking, they have reached their goals. Christie’s, for example, have brought in a total of 864 million dollars in transactions for their sales, with 16 record prices. Sotheby’s have brought 1.1 billion dollars with 10 record prices just for the last auction of 15 November.

Lack of transparency

Pablo Picasso

But certain methods they have used lack transparency. At the time of writing, the most disappointing auction of the season was the Sotheby’s impressionist and modern art sale on 13 November. The catalogue, which has been available online from the beginning of November, presented 41 lots but just before the auctions no less than eight works were withdrawn from the publication, most likely due to a lack of interest and guarantees.

Withdrawn Picasso and Guston

Among them were names as well known as Pablo Picasso, Philip Guston and Diego Rivera. Therefore, the official results published by Sotheby’s were very satisfying, with only two lots left unsold. The sale brought in 223 million dollars for 31 lots against an estimate of 179.4 million. Furthermore, the overall figures were inflated by a piece that had nothing to do with modern painting: the sale of a Ferrari GTO from 1962 for 51.7 million dollars, the record for this brand.

Withdrawn but in the catalogue

At Christie’s on 9 November, as part of a 20th-century sale that appeared to go well, two lots were withdrawn at the last minute only to remain in the catalogue, without being clearly distinguished from the only one that was unsold. This sale of 64 lots brought in 640.8 million dollars.

Amy Cappellazzo

The big change this season is the agility with which Sotheby’s and Christie’s have adapted, right up to the last minute, to the new prices imposed by the market. Amy Cappellazzo, who founded Art Intelligence Global, a services agency for collectors in New York, sums up the situation: “Buyers, in such a context, need to be recompensed for their involvement, through very reasonable estimates and reserve prices (2) that leave them some space. I see the future of the contemporary art market flourishing for masterpieces as well as for pieces by very young artists – with prices from 20,000 to 80,000 dollars”.

Brett Gorvy

For Brett Gorvy, co-founder of the American gallery Levy Gorvy Dayan, “there is still a lot of money available in this market. But we are observing a revision of prices on a case by case basis, depending on the artists and artworks. The cloud is there. The buyers who are very well informed have decided to invest significantly smaller sums of money. You also see it at the fairs.”

Here is the analysis of a few key artists from this season:

Pablo Picasso

Pablo Picasso

He is still the king of the 20th-century art auctions. Between 8 and 13 November Sotheby’s sold no less than eight paintings by the Malaga-born master, with a big splash for “Femme à la montre”, a painting from the highly prized year of 1932 from the Fisher Landau collection (See here the report about the Fisher Landau collection), which sold for 139.3 million dollars. It’s the second-highest price ever obtained for a Picasso and the biggest sale of the season. The Fisher Landau collection brought in 406.4 million dollars (total estimate: 350 million dollars).

Mark Rothko

Mark Rothko

It was not only modest in size (100×66.4cm) but also painted on paper. This was apparently a double handicap in the eyes of the market. Rothko made it towards the end of his life, in 1968, when the doctor forbade him from too much physical exertion. And yet on 13 November 2023 Sotheby’s sold this work for 23.8 million dollars against an estimate of 7 million. Never has a work on paper by the American artist gone for such a high price. It was one of the most spectacular surprises of the season.

Sunny Rothko

Mark Rothko

Between 8 and 13 November four Rothkos were presented at auction with a maximum price of 46.4 million dollars for a very sunny painting from 1955 in shades of orangey-yellow coming formerly from the legendary Mellon collection. In Basel the Acquavella Gallery presented this same canvas to no avail at the Art Basel fair in June 2023 for 60 million dollars (See the report about Art Basel 2023 in Basel here). It had been sold in 2014 for 36.5 million dollars.

Darker Rothko

Mark Rothko

However, there was disappointment for one of the darker canvases from the legendary Seagram Building series from the Fisher Landau collection. The canvas in shades of brown finally went for 22.1 million dollars to Taiwan, apparently, against an estimate of 30 million. This can be explained by the fact that the impact of these late paintings emerges when they are hung as part of the series. Market rumours also indicate that the Pace gallery, who presented a Rothko painting from the 1950s at the Paris+ fair for 40 million euros, have since sold it (See the report about Paris+ here). No doubt the exceptional exhibition at the Vuitton Foundation reinforced the desire to possess the artist’s works (See the report about the Rothko show here).

Claude Monet

Claude Monet

Between 9 and 13 November, nine paintings by the illustrious impressionist were presented in New York and sold for between 1.3 million dollars for a boring scene on the banks of the Seine from 1879 (estimate: 600,000 dollars) and 74 million for a sublime recently rediscovered “Bassin aux nymphéas” (with an estimate around 65 million dollars).

Claude Monet

The nice surprise is that an interesting painting from a Japanese collection, “Peupliers au bord de l’Epte, temps couvert” dated from 1891, presented without a guarantee by Sotheby’s and therefore without a safety net on the market, went for 30.7 million dollars, in accordance with its lowest estimate.

Joan Mitchell

Joan Mitchell

Women artists are having a spectacular rise in market standing. Along with Agnès Martin, Joan Mitchell, known for having spent a significant amount of her life in France not far from Claude Monet’s last house, was a member of the American abstract expressionism movement. Her work has long been underrated (See the report about Joan Mitchell here). On 9 November one of her large-scale paintings (247x219cm) dated from 1959 made up of an ensemble of very spirited gestures in shades ranging from red to purple punctuated with green sold for 29.1 million dollars (estimate: 25 million dollars). It’s a new record for the artist. The previous one, which dates from 2018, was less than 12.5 million dollars. On 15 November Sotheby’s sold a large triptych by Joan Mitchell from 1990 for 27.9 million dollars. Proof of the firmness of Mitchell’s standing in such a turbulent period.

Joan Mitchell

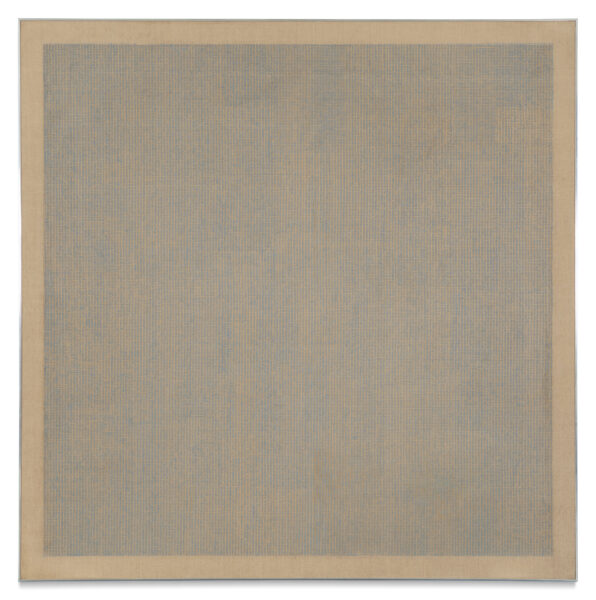

Agnes Martin

During her mature period she made a kind of pared-back, metaphysical form of painting, animated solely by discreet patterns, often lines and neutral hues. On 8 November one of the paintings by the American artist dated from 1961 sold for the record price for the artist of 18.7 million dollars (estimate: 6 million dollars). For Brett Gorvy this sale embodies what the market wants: “there are only three Martin canvases painted with gold leaf in this format and the other two are in museums. A unique opportunity.”

Agnes Martin

- (1) Guarantee: a sum whose payment is guaranteed by the buyer.

- (2) Reserve price: a price fixed by the auction house in agreement with the seller and below which an artwork cannot be sold.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.