Political and economic upheavals

As 2019 comes to a close, in a year shaken by various political and economic upheavals, observers may wonder what fate has in store for the modern and contemporary art market.

Stratospheric prices

Over the past few years, auction houses have been fuelled each season in the media by extraordinary record prices exceeding 50 million dollars at auction for a single artwork. We should point out that these stratospheric prices have a domino effect on art market morale and therefore at all levels of transactions.

Monet & Hockney

We can cite for example the 110.7 million dollars recorded in May 2019 for the Haystacks by impressionist Claude Monet, or the 90.3 million for a very Californian painting by British painter David Hockney in November 2018.

No trophy

Between 11 and 15 November 2019 Sotheby’s, Christie’s and Phillips have been auctioning their most remarkable lots in the areas of impressionist, modern and contemporary art in New York. But this time, with one exception, none of the “trophy” artworks were put on the market.

No deaths, no divorces among the big collectors

There are a number of reasons for this. The first has to do with a circumstantial fact: no deaths or divorces among the big collectors.

Harry and Lisa Macklowe

However, there is a pending court decision that will most likely result in the sale next year of the huge collection belonging to New York real estate developer Harry Macklowe and his ex-wife Lisa following their divorce. With works by Jeff Koons, Cy Twombly and Giacometti, the collection could be worth around a billion dollars.

Like-kind exchange

More broadly, the reduced number of pieces of exceptional quality is justified by the fact that America, home to the world’s leading collectors, has less incentive to sell because in 2018 the Trump administration repealed a tax measure that was very favourable to the art market, the “like-kind exchange”, which allowed for the deferral of payment of capital gains taxes in the case of a purchase within six months of a similar asset.

Philippe Ségalot

For Philippe Ségalot, the private dealer who lives between New York and Paris, this new tax reform – in addition to an international climate of uncertainty – does not encourage risk-taking. “The market is mature, selective and cautious,” he observes.

Less excitement

In the space of a season, there is therefore less excitement even though the field continues to attract a degree of interest, including for investors.

Adrien Meyer

In the modern art department at Christie’s, Adrien Meyer reveals that the auction house has been particularly solicited by clients looking to guarantee (1) artworks. 16 works have been guaranteed out of the 62 put on sale.

Watch the video to find out more

Thomas Seydoux

In modern art, as in contemporary, the results of the sales have been satisfying. Thomas Seydoux, the private Parisian dealer, observes: “While the volume of lots is declining relative to 2018 by about 30%, Sotheby’s has managed to sell 84% of the works presented and Christie’s over 90%. The market remains fragile, however, because there are less bidders for each lot.”

Caillebotte and Signac

More unexpected names among the stars of modern art sales have led to elevated prices, like 19.7 million dollars for a painting by the impressionist Gustave Caillebotte and 16.2 million dollars (14.7 million euros) for a spectacular landscape of Istanbul by the post-impressionist Paul Signac. It was sold for 7.7 million euros in 2012.

Grégoire Billault

At Sotheby’s New York, Grégoire Billault, the head of the contemporary art department, challenges this trend for “trophy” artworks. “The market today is led more by buyers than by sellers, and the art lovers want to hang on to their works. It’s a good sign, isn’t it? The interest in contemporary art remains strong.”

And in fact on 13 November Christie’s sold 89% of their presented lots and Sotheby’s sold 92% of their lots the next day.

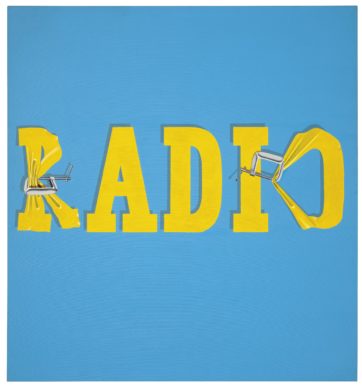

Ed Ruscha

The star canvas of the season is a painting by the Californian pop art veteran Ed Ruscha (born in 1937). This radical work from 1964 with the word RADIO written across it in blue against a yellow background hasn’t appeared on the market since the 1970s. Ruscha is known for his huge billboard works installed in landscapes on the West Coast of the United States. But here the letters are distorted by pliers. The composition is marked by a surrealist spirit, knowing that the blue is the sky and the yellow is the sun. With an estimate of 30 million dollars, it went for 52.4 million dollars at Christie’s, a record price for the painter.

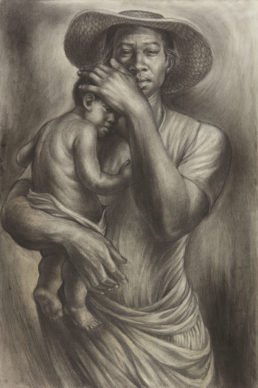

Charles White

This season also enables us to see artists emerge who are ordinarily obscured by huge prices. This is the case for Charles White (1918-1979), who was little known until October 2018 when Moma in New York dedicated a retrospective to him which also travelled to Chicago and Los Angeles. His forty-year career has been primarily dedicated to the African-American cause, in painting and drawing. A powerful line, head-on portraits sometimes reminiscent of the style of Mexican artist Diego Rivera… White also taught two key figures in current African-American creation who are also art market stars, Kerry James Marshall and David Hammons.

Watch the video to find oute more

One of his canvases from 1976 was sold by Christie’s for 1.2 million dollars. The following day Sotheby’s presented a charcoal piece exhibited at Moma the year before which sold for 1.8 million dollars. The increase in his market value is spectacular, since the biggest price for the artist up until now, achieved in 2018, was 485,250 dollars.

Political gains

The political gains made by this section of the American population, long overlooked by artistic circles, are also beginning to have a real impact on valuation. The art market is also a part of the echo of the end of the supremacy of purely Western modern art.

Sanyu

In this spirit, on 23 November in Hong Kong Christie’s will be presenting a painting depicting five nudes standing in a row, evidently a brothel scene, made by the Chinese artist who lived in Paris from 1921 onwards, Sanyu (1901-1966). It is estimated at 33 million dollars. This painting could well have been integrated into the sales in New York. Up until now, the record price for Sanyu has been set at 24.4 million euros. With his Matisse-like colours and his pared-back lines he created a significant oeuvre which the French museum world would do well to re-examine. Meanwhile it’s the world of China’s collectors, with their exceptional means, who are fascinated by his work.

(1) The guarantee is a process whereby an auction house enlists a third party to pay a set price if there is no sale at auction. In the case of a sale at a higher price than the one set, the third party will receive a share of the profits.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.