Claude Monet

The paradox of the art market

Nowadays the paradox of the major sales of modern and contemporary art in New York lies in the fact that almost all of them take place before the auctioneer has lowered the hammer. The strength and weakness of these public sales is the fact that the results that are made official and drip-fed to the online databases.

The important third-party guarantees

This is why (as I explained before the New York sales) international firms like Sotheby’s and Christie’s are increasingly and whenever possible using the tool of the “third-party guarantee”. This affords them the possibility of assuring a seller, well before the auction, that the work will be sold for a minimum sum to an entity that isn’t the auction house. The benefit for the seller is clear: assurance of a suitable result. For the guarantor the draw is to possess a piece they appreciate in exchange for a relatively reasonable amount.

Thomas Seydoux

In cases where on the day of the auction it is sold to a bidder prepared to invest more than the guarantor, the latter would receive financial compensation from the auction house. “It’s a season when operators are seeking to affirm a certain stability. Third-party guarantees allow them to do that,” explains private French private dealer Thomas Seydoux (See here an other interview of Thomas Seydoux).

Last minute withdraw

The other solution, in order to prevent a significant failure from being made public, involves withdrawing a lot at the last minute before the sale if the auction house feels they will not find a buyer at the right rate. The work then disappears from the radar. It is eliminated from the online catalogues and art databases.

Adequate results

In a period that has been chaotic in every respect and taking into account these two processes, the results this May 2024 have been perfectly adequate, even though the overall volume of auctions has been reducing for a year now. The sales at Sotheby’s have brought in 633 million dollars with 94% of works sold at the evening sales. At Christie’s, despite the huge stress caused by their website being hacked which took nearly 10 days to rectify – a watch sale for example had to be postponed – the modern and contemporary auctions still brought in 640 million dollars with 86% of lots presented overall finding a taker over the course of the week.

Phillips and Basquiat

Jean-Michel Basquiat

And yet it was the eternal outsider, Phillips, that managed to clinch the biggest sale of the season at 46.5 million dollars for a painting by Jean-Michel Basquiat, “Elmar” made in 1982. “This artist, a great colourist, has undeniably become a reference point for the late 20th century,” observes Doriano Navarra, son of Enrico Navarra author of the artist’s catalogue raisonné.

Yusaku Maezawa

In support of this statement, the day before the auction a private transaction concerning Basquiat was revealed, to the tune of 200 million dollars. It involved the purchase of a Basquiat canvas by Ken Griffin, founder of the Citadel hedge fund, from Japanese collector Yusaku Maezawa.

Jean-Michel Basquiat

Private sales at Gagosian

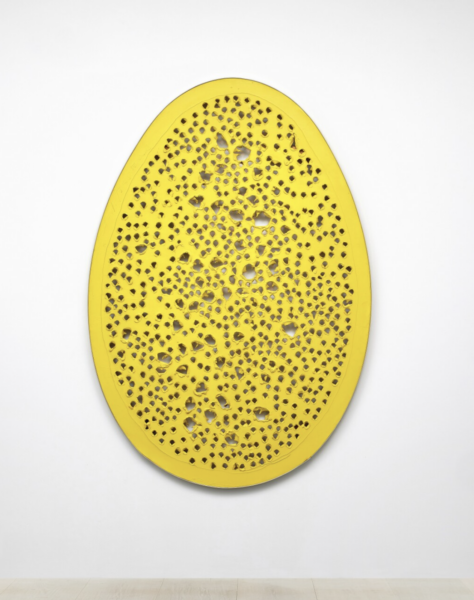

Andy Warhol @ Gagosian

The private sales that afford the possibility of relative discretion seem to be the key to the current market. The gallerist and leading global dealer Larry Gagosian inaugurated an exhibition during the week sales – it’s simply called Icons from a Half Century of Art – at the huge space of his gallery in Chelsea, New York, on 24th Street, accessible exclusively by appointment and showcasing around fifteen paintings on sale for several tens of millions of dollars. Basquiat features among the names presented, along with Rothko, Warhol, Lichtenstein, Richter… taking photos is absolutely prohibited.

Gagosian, New York

Here are a few names that have defined this 2024 season of modern and contemporary art auctions:

To appreciate is to support.

To support is to donate.

Support JB Reports by becoming a sustaining Patron with a recurring or a spontaneous donation.

The big disappointment for a Brice Marden diptyque

Brice Marden

The lot that spearheaded the contemporary auctions this season at Christie’s was a double canvas by highly esteemed painter Brice Marden (1938-2023) made between 2004 and 2007. He died recently and the work was set to symbolically be the crowning point of his career in the market. The American artist produced six paintings in the series “The Propitious Garden of Plane Image”, including one that is part of the permanent collections at Moma and another at the Centre Pompidou.

30.9 million dollars painting

Yet another was auctioned on 10 July 2020 for 30.9 million dollars. This would all seem to indicate that the painting presented at Christie’s was desirable. But these are no longer times for raising prices without limits, as we’ve seen for several years now. Just before the sale, the diptych with an estimate from Christie’s that was above the previous record, between 30 and 40 million dollars, and which was not subject to a third-party guarantee (it only had a guarantee by the auction house), was withdrawn from the catalogue. This failure is the strongest sign of the new phase of the art market that we have now entered.

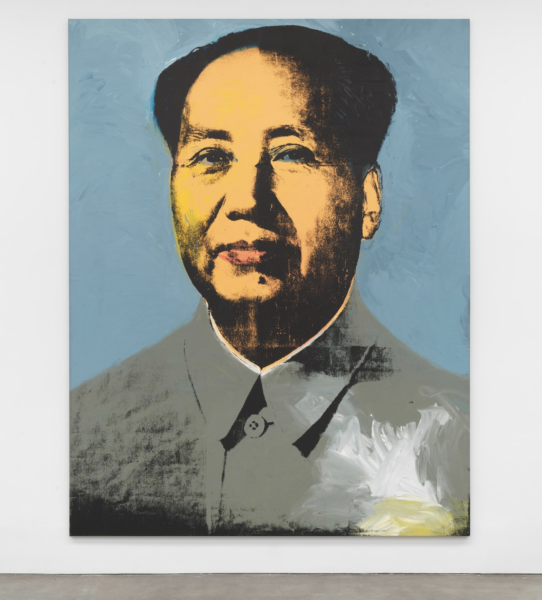

Lucio Fontana: The End of God

After a spectacular rise in prices, the art market has registered over the last two years a noticeable drop in the value of works by Lucio Fontana (1899-1968). The dealer who is a specialist on the artist, Michele Casamonti from the Tornabuoni gallery, estimates it is around 10%. Fontana is known for his monochrome paintings sliced across with one or several slashes, lending the painting a gestural third dimension. A radical act that the conceptual artist has nonetheless repeated 900 times under the name “Spatial Concept”.

Sky is not the limit anymore

In this ocean of “Concetto Spaziale” there is one particular series that ignites desire in art lovers. It’s a group of 36 paintings in the shape of a monumental egg made in different colours and always in the same size. He gave these monochrome eggs dotted with holes in the canvas a dramatic name: “La fine di Dio” (The End of God). For Michele Casamonti, who has published an entire book on the subject, the title of this series composed of 36 works simply indicates the end of modern art and a rebirth, for which the egg is the symbol.

Yellow is rare

Lucio Fontana

The yellow “Fine di Dio” dating from 1963 which belonged to Dallas collector Howard Rachofsky sold this season for 23 million dollars to the New York art adviser Neal Meltzer. Rachofsky acquired it in 2003 for what was then a record: 2.3 million dollars. In 2015 another “Fine di Dio” went for a sum that has never been equalled to this day for Fontana: 29.1 million dollars. The market still desires rare pieces by great artists but stops at sums that are less excessive than in the past.

Today the biggest collectors of “Fine di Dio” seem to be Miuccia Prada and her husband Patrizio Bertelli, who apparently possess no less than six of these egg-shaped canvases.

Leonora Carrington: the major record

It’s the big surprise of the season. In other words, how Leonora Carrington (1917-2011), a surrealist artist who was for a long time unknown to the wider public, had one of her canvases sold for the colossal sum in these dreary times of 28.4 million dollars. Remember that the previous record for the British painter, obtained in 2022, went up to 2.6 million dollars.

Alyce Mahon

For Alyce Mahon, professor of art history at Cambridge and specialist on surrealist women, this sale is only just. “This is a true masterpiece. The surrealists themselves didn’t draw a distinction between female and male artists. The movement is currently being revisited and revalued. This is what has already happened with Frida Kahlo and which should soon happen to Leonor Fini.”

Lover of Max Ernst

Leonora Carrington was above all known for having been in France the partner of another surrealist, the German artist Max Ernst. Then the Venice Biennale in 2022 put her in the spotlight again. Her meticulous painting style bathed in a fantastical atmosphere evokes the preciosity of the Renaissance. She painted “Les Distractions de Dagobert” in 1945 in this spirit. From 1942 until her death she lived mainly in Mexico where she also adopted the iconography of local mythologies.

It was an Argentine collector, Eduardo Costantini, who declared he had acquired the canvas for his museum, the Museo de Arte Latinoamericano, in Buenos Aires. Now Carrington’s market value is well above that of numerous other surrealists, starting with her lover Max Ernst (record: 24.4. million dollars) but also the far more famous Salvador Dali (record: 21.6 million dollars).

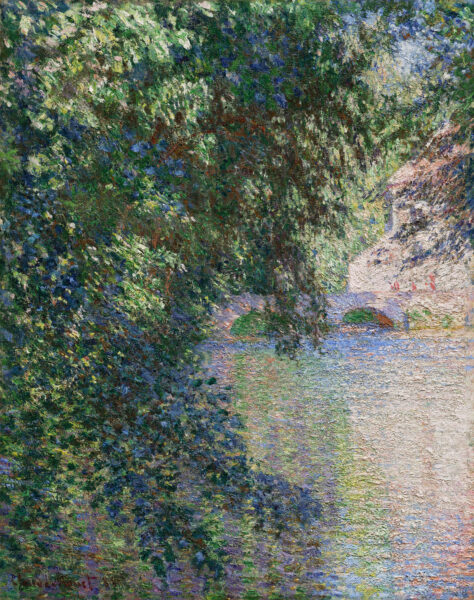

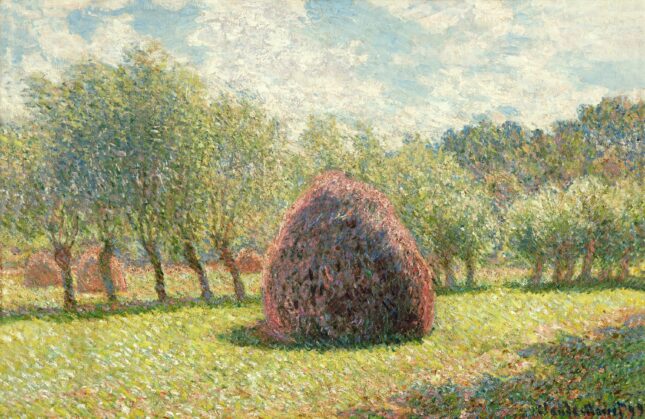

Claude Monet: Safe bet

Claude Monet (Sotheby’s)

Claude Monet (1840-1926), regardless of his period of work, remains an artist who is particularly desired at auction. He embodies a certain impressionist classicism for lovers of tradition and a genius who flirts obsessively with abstraction, in the latter part of his life, for those who are enamoured of the avant-garde.

10 Monet for a season

While there hasn’t been a great splash for him this season, no less than ten paintings by the Giverny master have changed hands on 15 and 16 May 2024 in New York. The star “Meule à Giverny”, a canvas depicting a haystack – which foresaw his future series of atmospheric effects around these straw mounds – sold for 34.8 million dollars conforming to estimates. It was only the twenty-seventh highest price ever obtained at auction for Monet. He remains a safe bet for collectors the world over.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.