Anxious observation

Joan Mitchell ( Sotheby’s)

After years of exponential growth, in light of a very difficult economic, political and social context, the entire modern and contemporary art world is anxiously observing a potential sharp drop in market prices. In galleries representing a roster of young and not-so-young artists, although there aren’t official figures, the transactions are without doubt falling very noticeably, and according to several informed observers closures may even be taking place in the medium term.

The Basquiat from Phillips

Jean-Michel Basquiat

And then there are the auctions, with their official results. The week of 13 May 2024 is when the sales take place in New York for impressionist, modern and contemporary art at Christie’s, Sotheby’s and Phillips.

Phillips is presenting on 14 May 2024 the work with the highest estimate of the season (40 million dollars), a painting by Jean-Michel Basquiat dating from his landmark year, 1982. It is the subject of a third-party guarantee. It belonged to the Italian Francesco Pellizzi’s collection. (See here a report about the Basquiat retrospective at Fondation Vuitton)

All these transactions will have an enormous impact on buyers’ morale and, through a domino effect, across all levels of business. That’s why these large-scale operators play it safe in what they present at these strategic public events.

The option of private sale

Claude Monet(Sotheby’s)

The first thing to observe is the circumstances. This season is not about showcasing big collections in the hundreds of millions resulting from major life changes such as divorce or death. Furthermore, when sellers decide they want to part with an artwork, in order to avoid a public failure they will often take the option of a private sale.

Grégoire Billault

Grégoire Billault, head of contemporary art at Sotheby’s, tells us “in early 2024 private sales represent the already colossal sum of over 400 million dollars. This is typical in times of uncertainty.” And he adds: “We won’t be hypocritical. The market is less strong. This season there isn’t a single work presented at auction for 80 million dollars for example. But the offerings remains comparable to in November 2023. Europe and the United States remain active, although in Asia business has slowed.” (See here an other interview of Grégoire Billault)

Top Rothko

Among the spectacular private transactions, the American business channel CNBC announced on 29 February 2024 the discreet sale via intermediary at Christie’s of a stunning painting from 1951 by Mark Rothko, “Violet Green and Red”, for around 100 million dollars to Kenneth Griffin, collector and founder of the Citadel hedge fund. The painting appeared on the cover of the catalogue raisonné. It belonged to another famous art fan: the Russian oligarch based in Monaco, Dmitry Rybolovlev. Other sources put the figure at 180 million dollars.

Third-party guarantee

Returning to sales at auction, the ultimate strategic weapon in these times when values are being questioned is the third-party guarantee. This “tool”, whose usage has been widely developed in recent years, allows a seller to ensure, before the sale, that the artwork will be sold for a minimum sum, to an entity that is not the auction house. The benefit for the seller is clear: the certainty of a suitable result. For the guarantor, it means possessing a piece that they appreciate in exchange for a relatively reasonable price. If it so happens that, on the day of the auction, it is sold to a bidder who’s prepared to invest more than the guarantor, they would receive financial compensation from the auction house.

Sense of certainty

Joan Mitchell ( Sotheby’s)

Lastly, for the market in general, the guarantee gives a sense of certainty that demand always exists. So Sotheby’s and Christie’s are, even just before the fateful moment when the hammer drops and up until the last minute, racing against the clock and working to find guarantors, in order to not maintain the prices themselves.

Giovanna Bertazzoni

“The first auction, that of the third-party guarantee, reassures everyone,” explains Giovanna Bertazzoni at Christie’s, vice-president of the 20th and 21st century department. “Nowadays plenty of cash is available but it is worth presenting the good pieces and having the sellers accept the right estimate. Our last sales in London and Paris signaled a certain solidity in the market.” (See here an other interview of Giovanna Bertazzoni)

A year ago at Christie’s the estimate for the 20th and 21st century week of sales was 766 million dollars. 922 million were obtained. This year it has an estimate of 580 million dollars.

Rosa de la Cruz

Christie’s is presenting an ensemble of highly contemporary art that is well known to international art lovers. The works belonged to Rosa de la Cruz (1942-2024), who was one of the famous Miami collectors and had a private museum there – a must-see for art lovers in the coastal city. The twenty-odd lots up for auction on 14 May are due to bring in at least 26 million dollars. Before her death her husband had started selling the flagship works of the collection in private transactions.

Felix Gonzalez-Torres

Felix Gonzalez-Torres

So there is the absence of one of the best known and most anticipated pieces by the American artist of Cuban origin, Felix Gonzalez-Torres (1957-1996), a pile of white candy symbolizing the portrait of a person through their weight (One can see it in the video of the New York Times style Magazine from 2007).

In the same series, in 2015 another piece sold holds the record price for Gonzalez-Torres: 7.6 million dollars. The artist’s idea was to show objects from daily life, “readymades”, as Marcel Duchamp said, but which have a sentimental aspect. Christie’s is nonetheless presenting another of his major pieces, dated from 1992: 42 lightbulbs held on a single electrical wire baptized “Untitled (America #3)”. They evoke the kind of lights lit in a vigil for the dead, a trace of their soul. The artist died of AIDS after his partner. In 2017 a piece with 24 lights sold for 5.1 million dollars. Gonzalez-Torres continues to hold a significant appeal. The lightbulbs series presented on 14 May has an estimate of 8 million dollars.

More broadly, this season the most high-profile artworks correspond to two names: Monet in impressionist art and Joan Mitchell in contemporary art.

Claude Monet

At Christie’s on 16 May the star is a very impressionist painting by Claude Monet dating from 1888 which jointly belongs to a museum in Kansas, the Nelson-Atkins Museum of Art, and to the heirs of the collectors. It has an estimate of 18 million dollars and benefits from a third-party guarantee. Three-quarters of the composition in shades of purple and green depict a very leafy tree at a site not far from Giverny. “Two versions of the same subject exist,” explains Giovanna Bertazzoni. It was after these that Monet started his famous series approach. In 2023 its almost-twin painting sold for 25.6 million dollars. Proof of Christie’s caution then…

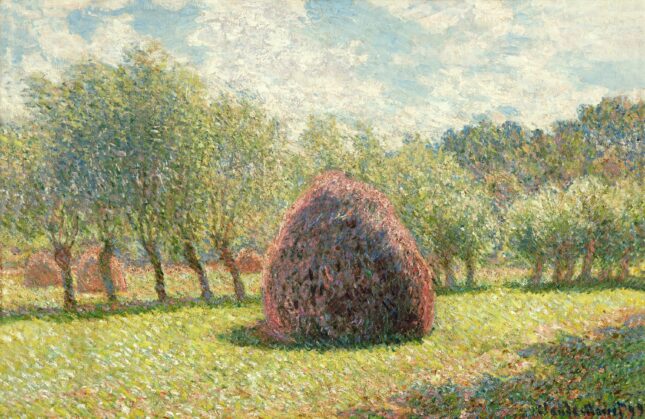

Meules à Giverny

Sotheby’s on the other hand are offering on 16 May “Meules à Giverny” painted in 1893 by Claude Monet with an estimate of around 30 million dollars, a guaranteed painting. The subject made in shades of acid green, purple and blue is one of the artist’s legendary themes.

Claude Monet (Sotheby’s)

In 2019 a painting of the same subject but which tended more towards the sublime, in fiery colours to illustrate a sunset, made in 1890, sold for 110.7 million dollars. Of course it was more grandiose but that isn’t the only reason that explains the difference in the value of the two works. We are clearly at another age in the market, one that is far more reasonable.

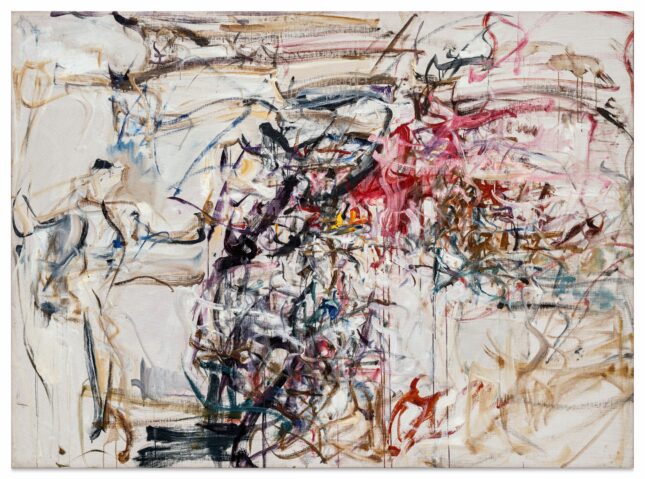

Joan Mitchell

Joan Mitchell (Sotheby’s)

By coincidence, Sotheby’s is presenting a series of four paintings by the contemporary artist who was potentially the most influenced by the impressionist master, to the point of basing herself close to where his studio was at Giverny, Joan Mitchell (1925-1992). The Louis Vuitton Foundation staged an exhibition-dialogue between the two artists in late 2022. (See the report about the exhibition here).

Greg and Stacey Renker

On 13 May four paintings from four decades by the abstract painter are being presented for between 1 and 15 million dollars by the auction house owned by Patrick Drahi. According to professional sources they belonged to Californian collectors Greg and Stacey Renker. 2023 was the best year, according to the Artprice database, in terms of transactions for the American painter who ended her days in France. Mitchell is even one of those rare artists whose market standing in recent years has risen significantly. In November 2023 a painting from 1959 was sold for 29.1 million dollars, the record price for Mitchell. By way of example, the painting estimated at 15 million presented by Sotheby’s – it dates from 1969 – was sold for 9.7 million dollars in 2016.

“I cary my landscapes around with me “

On 16 May Christie’s is also presenting a major work by Mitchell. Painted in 1987, with an estimate of 10 million dollars, it features beautiful soaring gestures in shades of yellow and blue, like a bouquet of flowers in disarray. Joan Mitchell said: “I carry my landscapes around with me.” This work is subject to a third-party guarantee.

Joan Mitchell ( Christie’s)

Christie’s website hacked

In a last-minute twist on Thursday 9 May, the Christie’s website was hacked just before the crucial week of Modern and Contemporary sales. By Sunday 12 May, it had not yet returned to its usual format, even though it was possible to access sales for the week of 13 May. This hacking should not add to the general climate of suspicion among buyers.

Donating=Supporting

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.