Sotheby’s

Patrick Drahi

It hit the art market like a bolt from the blue. On 17 June 2019, the French Moroccan-born businessman Patrick Drahi, who specializes in media and telecommunications, announced he had bought one of the world’s two leading auction houses, Sotheby’s, for 3.7 billion dollars. This move was somewhat surprising since, even on a personal level, he collects “classic” modern and contemporary art in a very discreet and relatively modest way via a very private dealer based in London. The announcement was accompanied by a reassuring message that said: “we do not anticipate any change to the company’s strategy”.

Luxury ebay?

Eleven months on and the company’s strategy has been transformed. “Drahi wants to turn Sotheby’s into a luxury eBay.” That’s the rumour currently doing the rounds in art market circles. To understand these relatively justified reports we have to examine the chronology of events.

Sotheby’s

Charles F Stewart

In October 2019, Drahi appointed a new head of Sotheby’s, a former employee from his telecommunications company Altice USA, Charles F Stewart. The first major decision was to separate the company’s activities into two areas: the Fine Art section and another department that could be described as “Lifestyle”, which bears the ill-suited name of “Sotheby’s Home” and encompasses design, watches, jewellery etc… This section has a very steady stream of offerings. A watches sale takes place online each week. One of the recent highest prices in this area dates from 16 April when a Patek Philippe Nautilus was auctioned for 484,000 dollars, with the sale as a whole bringing in 2.2 million dollars.

A substantial amount of debt

Sotheby’s

In April 2020, within a context of acute crisis and also faced with a substantial amount of debt, Sotheby’s made a large number of redundancies (there’s been talk of it affecting 14% of staff, mainly those in marketing, administrative posts and less prominent departments), along with pay cuts of up to 30% for directors of departments. If we believe in the “cost killer” reputation of the teams led by Drahi, we could imagine some regional offices may soon be closed and employees could be turned into consultants/business finders, like what has just happened to Allan Schwartzman, advisor to mega-collections around the world, who oversaw the company’s contemporary art activities since 2016 before announcing his departure on 12 May 2020.

No more printed catalogues

In the spirit of cost cutting, a majority of the sales catalogues – which up until now have been sent all over the world – are now apparently no longer due to be printed, apart from a few publications reserved for the major sales according to sources within Sotheby’s.

Amy Cappellazzo

But the real revolution lies in the omnipresence of the internet across all of Sotheby’s operations. The American head of the Fine Art section, Amy Cappellazzo, explains: “We’ve gone from being a publicly traded company to a private company that belongs to Patrick Drahi, who specializes in technologies, ran by a CEO who also specializes in technologies. But the transition started earlier. Nowadays there’s a significant market for private transactions and sales online. But there are events that merit a live theatricality,” concludes Cappellazzo, alluding to the sales of million-dollar masterpieces that will continue to take place live and in public.

Online contemporary auctions

Sotheby’s

Among the most spectacular results recorded recently, the latest Sotheby’s online sale in the field of contemporary art, from 14 to 17 May, took 13.7 million dollars for 117 lots. This is an unusually high sum for the online auctions sector. The star lot was a painting by the American artist Christopher Wool which sold for 1.2 million dollars. 29% of buyers were new clients, according to Sotheby’s. But it should be noted that the average value of works sold, which barely exceeded 110,000 dollars, is particularly weak compared to what the auction market has seen up until this point.

From the buyer’s point of view, while expenses are considerably lower when staging online sales, the fees demanded by the auction house remain the same: 25% up to 400,000 dollars, to which various taxes may be added.

Sotheby’s

Public/Private sales

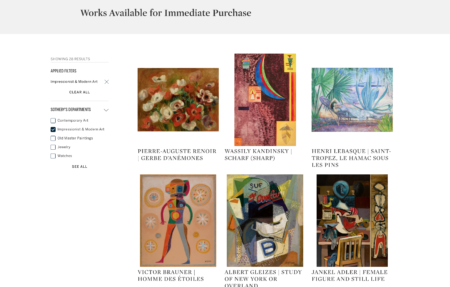

More broadly, for a long time Sotheby’s was primarily known as an auction house that staged auctions. But today private offerings, closer to the activities of dealers, clearly count among the company’s priorities, as Amy Cappellazzo acknowledges. Here the offerings are also divided into three categories: the first – and this is new – are private sales which are in no way discreet. On the Sotheby’s website you can now find a catalogue of works for sale that aren’t going under the hammer, from a bouquet of flowers by Renoir to a figurative painting by Gerhard Richter, via a lithograph by Roy Lichtenstein. No prices are listed, however. It’s David Schrader, who was a banker for 20 years, who is overseeing the private transactions for the company on a global scale.

Grégoire Billault

These include a second kind of offering: private and secret sales, those that are not featured on the website. According to Grégoire Billault, the global head of contemporary art at Sotheby’s, “we have significantly prioritized private sales over the past three years. In 2019 they represented a total of 1 billion dollars. We make private sales every day.” He adds: “the way in which we do business was not viable during the Covid crisis.

Sotheby’s gallery’s network

We had to come up with new approaches. Now we are also displaying artworks on our site that have been put up for sale by galleries.” This new platform is called the Sotheby’s Gallery Network and professionals as influential as the New York-based Gavin Brown or Lehmann Maupin have decided to participate. The idea is that galleries draw on their stock to present pieces with their prices made public. Up until now, the auction house was always traditionally considered to belong to the opposing camp, the galleries’ rivals who profit from the promotion of artists only to later generate speculation around them. But the Sotheby’s Gallery Network in fact gives galleries the opportunity to access the global network of Sotheby’s buyers at a time when art fairs are prohibited( except online). For the auction house, other than receiving a fixed percentage registered with each transaction (Sotheby’s refuses to reveal the amount), this also enables them to attract even more visits to the site from a young and hip audience.

Confidence: Selected masterpieces

In addition, Sotheby’s is staging a new offer in Hong Kong from 15 to 23 May 2020 entitled “In Confidence: Selected Masterpieces”, a hybrid operation, also in a new genre, which is both a private sale and features written bids sent to the auction house, along the lines of the eBay model.

Thomas Seydoux

“The proliferation of private sales, which I understand is necessary in these times of crisis, will lead the market towards a lack of transparency. We will no longer know not only what the auction price is but also how many people and what level of demand was sustained for the artwork,” concludes private French-Swiss dealer Thomas Seydoux.

The policy of intensive online marketing, with a steady stream of sales, could also deprive the auction house of its exclusive status as bringer of dreams and social prestige now that it’s seeking sales here there and everywhere.

But what’s for certain is that the art market, based on traditional models that are several centuries old, is entering the digital age in terms of its profound transformations, which are only just beginning.

Sotheby’s

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.