Strong on all fronts

In New York, the sales of modern and contemporary art at Christie’s and Sotheby’s, which have been unusually spread over two weeks (1), take the pulse of the market as the world gradually starts to come out of confinement. From impressionist art to an NFT work, the offerings are re-emerging as particularly strong on all fronts.

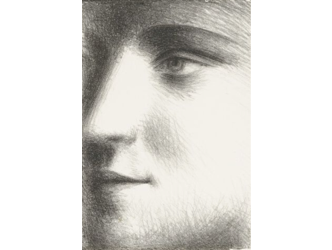

Xinyi Cheng. Oil on canvas. 2017. 300,000 dollars

Xinyi Cheng

How do you create a new kind of figurative painting in the 21st century? We find some answers to this question at the exhibition from the Pinault collection at the Bourse de Commerce, which opened in May 2021 in Paris (See here the report about the Bourse de Commerce). It displays canvases by a young Chinese artist Xinyi Cheng (born in 1989), among others, who has been living in France since 2017. (See here the report about Xinyi and the interview of the artist).

Contrasting colours

Her immediately recognizable creation consists of great flat tints of contrasting colours which don’t dwell on the details. She depicts attitudes, situations, and often young urban figures which are very contemporary.

A genre of her own

This combination of a composition of clashing shades and stills from current scenes mean she is within a genre of her own, a fact that has not escaped the Palais de Tokyo, or the Hamburger Banhof in Berlin, or the thirteenth Shanghai Biennale where she’s already been exhibited. In 2017 her large-scale canvases were sold by the Parisian gallery Balice-Hertling for 8000 euros.

Daniele Balice

One of these works has just sold on 9 November 2021 at Christie’s in New York for 300,000 dollars. Daniele Balice confirms: “We discussed this result with the artist. It won’t change anything in her practice. Of course it’s nice to have the validation of the market.

She produces little

But Xinyi produces very little even if we receive very strong international demand.” Xinyi Cheng’s paintings are now sold by the gallery for around 40,000 euros. In March 2022 she will be the subject of an exhibition at the Lafayette-Anticipations foundation in Paris.

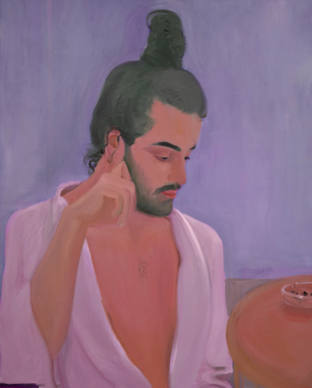

Beeple. Human One. Digital art: 28.9 million dollars

In March 2021, the “traditional” art world was caught off guard when a work by an unknown artist which assumed the intangible form of an NFT was sold for 69.5 million dollars. “Everydays, the first 5000 days” was made by the American artist Beeple, also known as Mike Winkelmann (who was born in 1981). The work in itself, although it seems to be of limited aesthetic interest, did however present three advantages. (See here the report about the record price).

First time

Beeple

The first, like its name indicates, was its quantitative importance, since it was a compilation of digital drawings made over 5000 days. The second was that it was the first time an NFT of such importance was put up for a “traditional” sale.

Traceability

The NFT, non-fungible token, is sort of like DNA for the artwork which guarantees is owner traceability with no equivocation over its authenticity as well as its commercial journey. It is crucial for the new forms of art that are digital arts but also for videos, for example. The third is that the auction house Christie’s accepted payment in bitcoin. Today there are massive new fortunes made from blockchain technology. This sale allowed them to enter into the classical system of the art market.

Television with four sides

Beeple

On 9 November 2021, Christie’s renewed a direct agreement with Beeple. “Human one”, conceived in 2021, is a piece that is absolutely unprecedented in its genre, and is hybrid and evolving. Its visual presence could be summed up by saying that it is a kind of television with four sides.

Ryan Zurrer

Inside it we see a figure wearing a space suit who is walking through changing scenery. It was bought for 28.9 million dollars by an early-adopter crypto-investor based in Switzerland, Ryan Zurrer. He tells us: “It’s a major event that includes the Metaverse (2) in our culture. I think I got it for a good price. I thought I’d be paying 40 or 50 million for it. This work deserves to be exhibited in a museum. We are already in talks with some of them.”

Jehan Chu

It was another long-time crypto-investor and former art adviser in Hong Kong, Jehan Chu, who introduced Beeple to Ryan Zurrer. “Since 2016 I have been working with NFT artists and helping traditional institutions to understand what the metaverse and NFT space are.

The most important work in the past 20 years

I think that ‘Human one’ is nothing less than the most important work made in the past 20 years. It is the first time that the physical world and the digital world have met. The piece will evolve over time, being added to by the artist through the blockchain. Beeple has committed to this. This work will also generate other artworks over the course of the artist’s lifetime.

Aesthetic revolution

It is a kind of like a chain between the artist and the collector. Here, Mike has imagined a new practice. He is not really from an artistic background. But he’s learning.” There is no doubt that the collaboration of the auction houses with artists who use NFTs will give rise in the very near future to aesthetic revolutions that are important to keep an eye on, in spite of the very mediocre standard of the general offerings in this domain.

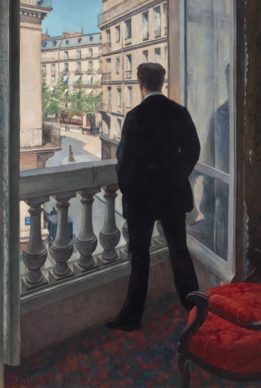

Gustave Caillebotte: “Jeune homme à sa fenêtre”.1876. 53 million dollars

Gustave Caillebotte

Out of all the impressionists, Caillebotte is subject to special treatment. Firstly because, unlike his contemporaries, he was not championed by the great dealer and international flagbearer for the impressionist movement, Paul Durand-Ruel. Next because he was not only a great collector of his artist friends, but his fortune also meant he didn’t have to make sales for a living. He had money.

Testament to burgeoning modernity

His work can be deconstructed into two major trends: a verdant landscapist streak and a very urban, more radical production which was a testament to the burgeoning modernity of the time. So in 1876 his “Jeune homme à sa fenêtre” looks out onto the city, with its Haussmann-esque apartments.

For the Getty

The work went for 53 million dollars to the Getty museum in Los Angeles, who immediately announced its purchase. This is the record price for the artist. In 2000 another “Homme au balcon” painted 5 years later already set a record price: 14.3 million dollars.

Adrien Meyer

Certain observers were wondering, before these sales, whether demand in the impressionist field was still being fuelled. The price scale practiced here offers an answer. “We thought it was 1989,” says Adrien Meyer, co-head of impressionist and modern art at Christie’s. “The desire to buy is very noticeable following the height of the public health crisis which saw a drop in supply from the auction houses and the cancellation of fairs. Over 50% of purchases were made by Americans.”

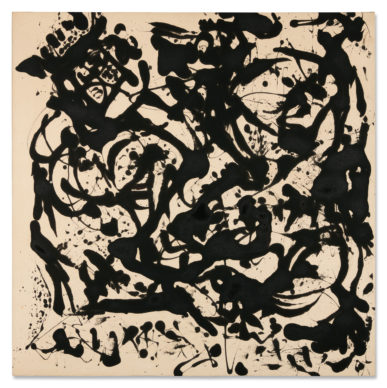

Jackson Pollock. Number 17. 1951. 61.1 million dollars

Jackson Pollock

“Last July, when we signed for the sale of the Macklowe collection, we didn’t know what the global situation would be. The timing has been perfect,” explains Simon Show, vice-president of the Fine Art department at Sotheby’s, following the auction on 15 November. The first part of the dispersal of the most hotly anticipated collection in recent years (see the report on the subject), which belongs to a divorced New York couple, has brought in 676 million dollars against an estimate of 435 million.

Consistent interest for contemporary art

A victory for the auction house and confirmation of the consistent interest shown to contemporary art on a global scale. While certain countries remain closed amid a public health context which remains uncertain, the works themselves have travelled, and 23,000 people have seen parts of the Macklowe collection, from Hong Kong to London.

Rothko

The average value of the 35 lots in the sale goes up to 19.3 million dollars. The highest price was obtained that evening for a painting in acid tones by Rothko made in 1951, which reached 82.4 million dollars (against an estimate of 70 million), after endless auctions.

Mark Rothko

The real surprise

But the real surprise of the evening was a monochrome painting by Jackson Pollock, also dated from 1951, estimated at 25 million dollars and sold for 61.1 million dollars. It belonged to the Metropolitan Museum, to the collector Sam Newhouse (ed. former owner of Conde Nast) then to Ronald Lauder (ed. co-heir to the Esthée Lauder cosmetics empire). This is a record price for the American painter known for his choreographies while he held his paintbrush over the canvas.

Justin Sun

Alberto Giacometti

The Chinese crypto-investor Justin Sun, who we interviewed after he bought a Picasso from 1932, has this time acquired a Giacometti from 1949, “Le nez”, for 78.4 million dollars. He wants to produce NFTs from his collection of tangible art. (See the report about his interview)

An other context

Following the auctions the co-owner of the collection, Harry Macklowe, couldn’t hide his satisfaction, adding that it was “moving to see the works in another context”. Sotheby’s has provided a general guarantee (3) for the collection, the sum of which has not been revealed.

Patrick Drahi

The owner of the auction house, the French businessman Patrick Drahi, stood at the back of the room throughout the auction observing that everything ran smoothly. After the hammer fell for the last time, he seemed just as satisfied: “I am happy because the collectors are happy. Selling an artwork is even worse than selling a company. I am a collector myself. I’ve never sold anything.” Next May Sotheby’s will be auctioning the second part of the Macklowe collection, estimated at 180 million dollars.

(1) At the time of writing this article we are still awaiting some results from Sotheby’s.

(2) The metaverse contraction of meta and universe corresponds to the ensemble of new virtual worlds (augmented reality etc) connected to the internet.

(3) A minimum sum that the owners will receive whatever the outcome of the sale.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.