Every year in November and May, the contemporary art auctions in New York are awaited as the final verdict on the overall health of the art market.

Their impact is colossal, trickling down across all price ranges, as well as across other areas of the market.

This year Sotheby’s and Christie’s have set the date for 14 to 17 November, to include both contemporary and Impressionist and modern art.

The auction houses have, it seems, considered the consequences of these high-profile auctions on the market’s overall morale.

At the end of the ’80s, their low sell-through rates conspired in slowing down sales considerably across the world.

Today, Sotheby’s and Christie’s are showing themselves to be more cautious, which partially explains the lower volume of works on offer.

‘We’re rejecting low quality works. We’re also rejecting works from owners asking for excessive prices,’ explains Brett Gorvy, the international head of the contemporary art at Christie’s.

According to Gorvy, since last year the number of lots estimated at $20 million and above has dropped by two-thirds, while works estimated at between $5 million and $20 million have fallen by half. Works under the $5 million dollar mark are – still according to Gorvy – unchanged in number at the prestige sale taking place on 15th November.

‘We’re in a transitional period in which sellers still expect to obtain high prices. Moreover, the current climate means that parting with quality art is not considered a sound economic decision. Money is cheap. Selling means taking a risk. People are nervous. They’re waiting to see what happens in the US elections. They’re also waiting for a calmer global outlook. But obviously the people we’re discussing, potential buyers and sellers, are financial colossuses.’

Brett Gorvy gives an effective lesson on the art market:

The 65 lots at the auction on 15th November are estimated to fetch $228 million.

The star of the sale is an abstract work by the American painter Willem de Kooning (1904-1997) from 1977 estimated at $40 million. In 2006 it was sold by the same auction house for 21.1 million euros ($27.1 million). That is a significant potential realised gain for a painter who figures among the great American names of the 20th century.

The other star of Christie’s contemporary art auctions is a work by a painter who is currently in fashion and who is represented by galleries including the Gagosian. John Currin (born 1962) is inspired by the Old Masters for his technique, but parodies the female universe, in particular American high society.

The record paid at auction for a Currin was 4.2 million euros ($5.4 million dollars) in 2008. It was for the painting that will be going under the hammer again on 15th November. It shows two nude women set against a dark background; their bodies register the passage of years and they display an ambiguous attitude. The painting belongs to the well-known collector from Connecticut, Peter Brant, and has a guaranteed minimum price of $12 million, meaning that a third-party is willing to pay that sum regardless of the outcome at auction.

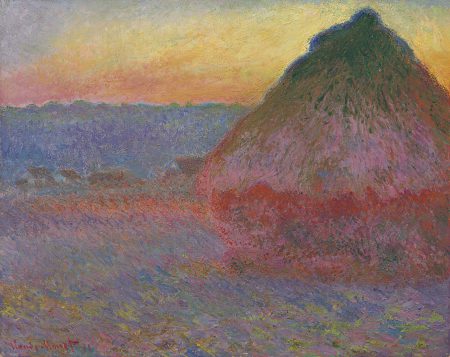

In the absence of a significant number of expensive contemporary lots, Brett Gorvy also discussed a Monet going under the hammer at Christie’s on 16th November at the Impressionist & Modern sale. In the pink, red and green hues of sunset, it is one of 25 versions of ‘ Les meules’, ‘stacks’ painted by the artist at different hours of the day in the Normandy countryside.

The 1891 canvas, an archetypal Impressionist work, belongs to a Denver collector and is estimated in the region of $45 million. In 1999 it sold for 11.3 million euros ($11.9 million).

At Sotheby’s, Amy Cappellazzo, international head of contemporary art, also makes a point of mentioning the star of the Impressionist & Modern sale on 14th November. It is a painting by the Norwegian Edvard Munch estimated at $50 million, making it the most expensive lot this season. ‘Girls on the Bridge’ is one of the most famous Munch paintings after ‘The Scream’.

The work made in 1902 sold for 18 million euros ($28 million) in 2008.

Amy Cappellazzo talks about the most significant paintings at Sotheby’s this season:

The contemporary art sale on 17th November at Sotheby’s, with 64 lots estimated together at $208 million, is mainly comprised on the collections belonging to Steven (who passed away in March 2016) and Anne Ames, both discreet but passionate New York art enthusiasts.

‘Steven even went back to university in the ’90s to study history of art,’ says Amy Cappellazzo.

One of the lots, another painting by de Kooning, was on loan to the White House for a time before being acquired by Ames.

There is even a photo of Hillary Clinton, then first lady of the United States, posing by this painting from 1983 made of whorls of colours.

The estimate for the work is $8 million. The Ameses were especially interested in painting and the collection includes several paintings by the German artist Gerhard Richter that go up to $30 million estimate.

This season, as we can see, the biggest names in the art market, the paintings that attract international headlines, are few and far between.

The timing of these sales, taking place immediately after the US presidential elections, clearly plays its part.

But regardless of the cyclical factors likely to impact the market in fall 2016, the interest and the demand for high-end 20th century art remains resilient.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.