At Art Basel 2023

Slow down

The art market always has a few surprises up its sleeve. While at the New York auctions in May prices showed a certain degree of slow-down – naturally enough, given the global context – at the opening of the Art Basel fair on 12 June the Perrotin gallery announced they were in exclusive negotiation with an investment firm called Colony Investment Management that is in talks to acquire a 60% stake in this gallery of French origin, which has 13 branches around the world, from Dubai to New York.

Rationalization and financialization

Jean-Marie Appriou

This resonates as a sign for the market on two levels, both that of a rationalization and a financialization of a field often considered to be bohemian, but also as a good omen in terms of the appeal of current art today. The whole fair was buzzing with this news and a very well-informed professional in the sector, who prefers to remain anonymous, remarked, “the surprising thing about this announcement is not the fact that a financial body is acquiring a stake, since ultimately this is a fairly common thing for galleries, but rather that it has been made public, and that Emmanuel Perrotin is relinquishing control of the Perrotin brand by giving up 60% of the stake.”

Emmanuel Perrotin

Emmanuel Perrotin himself declares that “this agreement allows me to stabilize the gallery’s situation and to develop it in a way we’ve been dreaming of for a long time.” The dealer is thereby opening the door for the next initiatives of this kind to be made public.

284 galleries

Mark Rothko

On the opening day at Art Basel, the fair, with its 284 galleries, was unusually packed. However an American dealer remarked: “Market prices are falling by at least 20%. In New York, sales have slowed down and a number of our clients are finding this period is not one for big trips to Europe and buying artworks. Some are also waiting to visit the Paris+ fair in October.”

Acquavella

But an influential gallery such as the famous Acquavella in New York hasn’t hesitated to make the trip with a painting by Mark Rothko, on sale for probably the highest sum in the fair: 60 million dollars. The canvas, in shades of yellow and orange and dating from 1955, belonged to one of the most famous Rothko collectors, Bunny Mellon, and was auctioned in 2014 for 36.5 million dollars.

Art Basel 2023

Vincenzo de Bellis

Vincenzo de Bellis, director of the Art Basel fairs, points out that: “In March the results of Art Basel Hong Kong were particularly satisfying. In Basel the participants are completely playing the game by bringing exceptional pieces here.”

Alberto Mugrabi

Alberto Mugrabi

The famous New York art dealer Alberto Mugrabi, who has come to Basel as a visitor, observes: “in recent times the market has evolved in favour of buyers. But it is doing much better than what people would like to say. Of course, the world is in the grip of many uncertainties and in this respect sales are dropping, in certain cases by 20% or more. I’m observing that nowadays consumers of art are more deliberately moving towards icons of modern and contemporary art. At Art Basel I have made an offer on a Giacometti sculpture. I am waiting to hear whether it will be accepted. I recently sold a Picasso painting for 16.5 million dollars while I was hoping to sell it for 18 million. But I have had it for a while. Artworks must circulate…”

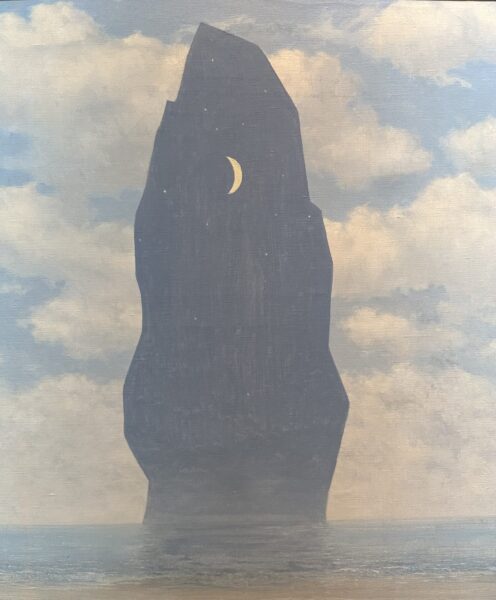

René Magritte

At the booth of the American gallery, Mitchell-Innes & Nash, David Nash is presenting a canvas by René Magritte dating from 1962, “Le baiser”, on sale for 7 million dollars. Sold in 1986 for 180,000 dollars, it depicts an enormous rock standing in the sea against a background of a cloudy sky, over which a crescent moon is reflected. The Belgian surrealist is an artist who is particularly in demand . According to the veteran modern art dealer, 10 years earlier the canvas was listed with a value of 2.5 million euros. He points out that: “in the current context there are two kinds of buyers: those who consider art to be a financial investment and who have recently seen interest rates go up. They prefer to abstain at the moment. On the other hand, the true collectors continue to make acquisitions.

René Magritte

Major transactions

From the day of the opening, the leading galleries were publicizing major transactions, which were the result of presenting to potential clients well in advance of the fair.

Louise Bourgeois

Louise Bourgeois

The behemoth Gagosian gallery, for example, announced 40 sales, which ranged up to 6 million dollars, and the multinational Hauser&Wirth made public the sale for 22.5 million dollars of a famous bronze spider measuring 1.9 metres long by the French-American artist Louise Bourgeois( See here a report about Louise Bourgeois at Kunstmuseum Basel).

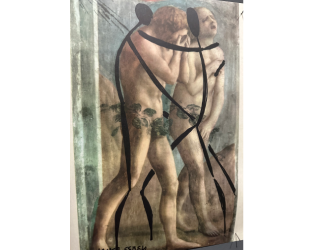

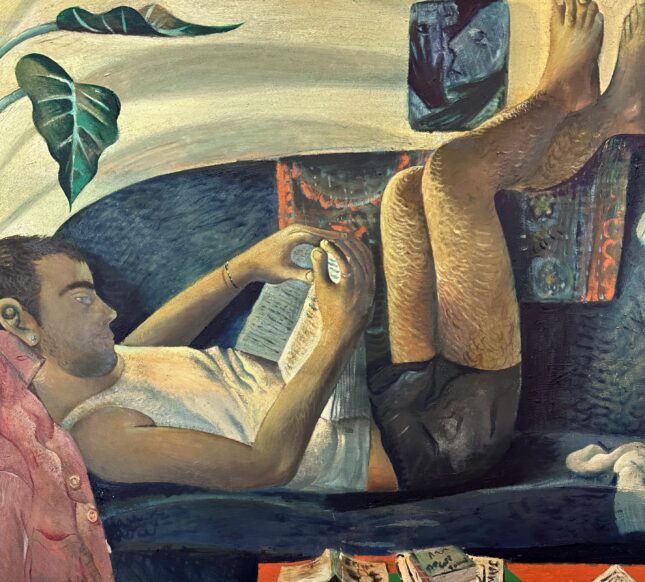

Louis Fratino

Louis Fratino

In terms of younger artists, the Neu gallery in Berlin is exhibiting a painting from 2023 by the high-profile American painter Louis Fratino (born in 1993). It was immediately sold for 65,000 dollars to an Italian collector. Fratino, who was first represented in France by the Ciaccia-Levi gallery, is now caught up in a whirlwind of speculation. Known for his intimate scenes produced in a cubist style, he saw one of his canvases sell at auction for 730,000 euros in November 2022 ( See here an other story about Louis Fratino).

Adel Abdessemed

One of the attractions of Art Basel is its Unlimited space, reserved for XXL format artworks. This year the first work on view in this large hall is a new spectacular work by the French-Algerian gallerist Adel Abdessemed (born in 1971) presented by the multinational Continua gallery. On a 12-metre-long screen a film is unveiled, showing a boat in flames gliding over the sea, with the artist onboard gazing into the horizon.

It’s a striking image showing the climate threat hanging over us in the early 21st century. Abdessemed reveals how he filmed these images off the coast of Senegal, inspired for the representation of this shipwreck by William Turner and Théodore Géricault. The film by Abdessemed, released as a single version in this format, is on sale for 850,000 euros.

Jean-Marie Appriou

Another French artist showcased at Art Unlimited has also used a boat as inspiration. Jean-Marie Appriou (born in 1986), who is represented at Art Basel by no less than five galleries, Clearing, Massimo de Carlo, Jan Kaps, Perrotin and Eva Presenhuber, has conceived a galleon made from aluminium measuring 5 metres long, which has two passengers dressed as astronauts. The anachronistic representation addresses, according to Appriou, the current obsession with space exploration, which he likens to that of the crossing of oceans in the Egyptian mythology . The imposing vessel is on sale for 700,000 euros.

Gerhard Richter

Art Basel is therefore an occasion to showcase the latest, most daring artistic propositions. The multinational gallery belonging to David Zwirner is exhibiting new sculpture made by one of today’s best-known “classic” painters, Gerhard Richter (born in 1932). Between 2011 and 2015 he produced horizontal digital impressions made up of countless polychrome stripes. Here he has conceived a kind of tower standing 3.5 metres tall, which uses the same vertical principle, with eight interlaced plexiglass panels covered in the same kind of stripes. The work is on sale for 2.5 million dollars.

James Murdoch

In November 2020 the intervention of another financier in the art world caused a media storm. This was when James Murdoch, the son of Rupert Murdoch, the media magnate, announced that he would be becoming the main shareholder of the parent company of Art Basel, MCH Group. He recently talked on a podcast on the Artnet website about the need to develop Art Basel’s business.

Noah Horowitz

On the issue of possible transformations for this leading fair in the field of contemporary art, its CEO, Noah Horowitz, responds reassuringly: “We are building up our teams. We are developing communication.”

Contemporary art has never been so in fashion. It is therefore attracting other sectors seeking to take over and reap benefits. This is just the beginning of these kinds of alliances between the markets for art, finance and luxury.

Gerhard Richter

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.