Huge responsibility

The major auction houses have a huge responsibility with regards to the entire art market. Through the publication of their official auction results – combined with market databases such as Artnet or Artprice acting as megaphones – they are supposed to reflect the major consumer trends in this field, especially during this period of dramatic uncertainty.

Enormous pressure

Are people buying art? At what price level? Are people selling more at the moment? What artworks are selling well? It is under this enormous pressure that Christie’s and Sotheby’s are staging their auctions of modern and contemporary art, now in a more dispersed fashion.

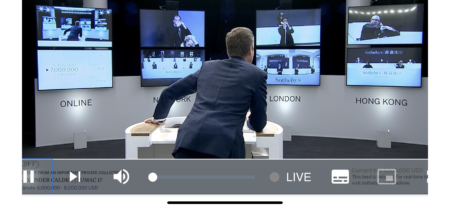

28 October 2020

The latest, which was naturally highly anticipated, was the Sotheby’s auction on 28 October. It took place virtually in New York, Hong Kong and London and was overseen by the auctioneer Oliver Barker, who sat alone in front of three screens on which in-house specialists could be seen bidding on behalf of their clients. This was an example of what Sotheby’s calls a “marquee” sale, and this time it featured art from the late 19th century to the early 21st century alongside design (a table by the Italian Carlo Molino from the Brooklyn Museum was auctioned for 6.1 million dollars) and car prototypes (3 Alfa Romeos from 1953 to 1955 were sold for a total of 14.8 million dollars).

Far from pre-Covid sums

More specifically the modern art sale brought in 141 million dollars (with 100% of lots sold) and the contemporary art sale recorded 142.8 million dollars (with 95% of lots sold). This is still very far from pre-Covid sums but the results on paper were very satisfactory.

Thomas Bompard

“During this period we mustn’t present too many lots at our sales,” emphasizes Thomas Bompard, modern art specialist at Sotheby’s Paris. “In the majority of cases clients are unable to travel to see the artworks. The works must therefore be well promoted.”

Sealed bid

Sotheby’s, clearly conscious of the wider impact of the results on market psychology, have gone to great lengths to prepare for these auctions. One of the star lots was a “Grande femme 1” by Alberto Giacometti, a bronze work measuring 2.7 metres tall, allegedly sold by the bankers of American billionaire Ron Perelman whose business is currently struggling, which was put up for auction in an unprecedented hybrid format – halfway between a public and a private sale – known as a “sealed bid”. In other words, the work benefited from maximum media exposure. It was even announced that it could be valued at 90 million dollars. But then the sale was conducted in private and secret bids were accepted by independent lawyers. This led to the American art magazine Hyperallergic running an article with the title: “Sotheby’s conceals final sale price of monumental Giacometti sculpture”. A specialist who prefers to remain anonymous is stunned by the overvaluation of the work by Sotheby’s and points out: “In 2017 a ‘Grande femme’ in a posthumous cast (1) was sold for ‘only’ 29.4 million dollars. There’s nothing to justify the jump in price advocated by Sotheby’s this time around.”

Giacometti withdrawn

It should also be noted that despite the sale for 25.9 million dollars of another Giacometti sculpture, “Femme Léoni” from 1958, a third bronze by the same artist entitled “Femme de Venise IV”, made in 1956 and estimated at 14 million dollars, was withdrawn just before the sale, apparently due to a lack of bidders. It was also removed from the catalogue on the Sotheby’s website. This is another way of making the results appear more favourable.

Thomas Seydoux

“No fairs, no viewings, no exhibitions… What Sotheby’s has achieved is miraculous. The clear message is that there’s still life in the art market,” counters the private modern art dealer based in Paris, Thomas Seydoux.

Bombshell

The bombshell on 28 October was that the Baltimore Museum, only 5 hours before the auction and in the face of public disapproval, withdrew three contemporary artworks that had come from their permanent collection with a total estimate of 65 million dollars.

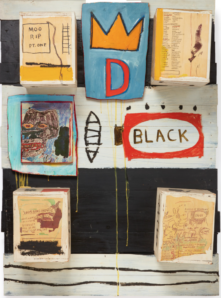

Jean -Michel Basquiat

However, two works by Jean-Michel Basquiat which had belonged to the French dealer Enrico Navarra – who died in July 2020 – went for 8.1 and 6.9 million dollars respectively, which was much more than the higher estimates. Navarra is the author of what serves as the American artist’s catalogue raisonné and the works feature on the cover of this reference work.

Matthew Wong

Among the younger artists, against all odds the Hong Kong painter Matthew Wong (1984-2019) is currently subject to a wave of enthusiasm worthy of the heady days of art market speculation (see the interview with the Christie’s specialist who talked about the artist in June 2020).

One of his brightly coloured landscapes, as his often are, dating from 2019 and estimated at 200,000 dollars obtained 1.6 million dollars on 28 October. But most significantly, on 7 October 2020 Christie’s auctioned a 2017 canvas of his for 4.4 million dollars. The work had been acquired at Art Basel Miami at the booth of the French gallerist Franck Elbaz for 21,000 dollars.

Grégoire Billault

For Grégoire Billault, head of contemporary art at Sotheby’s, “this is classic behaviour in the field of contemporary art. Certain buyers have realized after the artist’s death how important he was.”

David Nahmad

The major unsold item at the Sotheby’s evening sale was a painting by one of the giants of American abstraction, Mark Rothko, estimated at 25 million dollars. For famous dealer David Nahmad “it doesn’t mean it’s any big sign for the Mark Rothko market. It is simply the kind of painting that needs to be seen in person, like a number of impressionist works for example. I wasn’t able to travel to observe the surface, the texture of the work. So I preferred to abstain. But a comparable painting was sold for 31 million dollars at Christie’s on 6 October.”

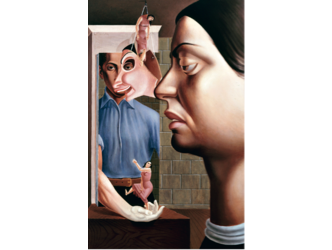

Giorgio de Chirico

The same David Nahmad (see his interview about the Picasso work he bought for 115 million dollars) talks about being the underbidder for the most popular modern painting of the evening: a canvas from the metaphysical period of Giorgio de Chirico which sold for 15.8 million dollars. It was made in 1913 while the Italian painter was establishing his dreamlike visual language that would go on to be associated with surrealism. Throughout his career he reproduced scenes of great urban solitude, as shown in the exhibition at the Musée de l’Orangerie in Paris (2), currently suspended due to Covid. “Ariadne’s Afternoon” once belonged to the late owner of L’Oréal, Liliane Bettencourt.

It’s the record price for a Giorgio de Chirico. And against all expectations, it was obtained right in the middle of a period of global lockdown.

(1) The work presented on 28 October 2020 had been cast in bronze during the artist’s lifetime.

(2) Giorgio de Chirico. La peinture métaphysique (Metaphysical Painting). www.musee-orangerie.fr.

Donating=Supporting

Support independent news on art.

Your contribution : Make a monthly commitment to support JBH Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.