Art Basel Unlimited

A colossal amount of money

There has never been such a large number of contemporary art fairs in the world. Auction sales of current artistic creation bring in a colossal amount of money. Artists who are in fashion – thanks to social media – have never been so famous on a global scale. The system is so tightly knit that collectors are all looking in the same direction.

Collecting is cool

Art Basel Hong Kong

Taking an interest in artists nowadays, from Bangkok to Dallas, is seen as a cool thing to do. Should you choose a painting that’s beautiful or unsettling? How do you find your bearings with all these offerings that don’t follow any standards? To answer these questions, vocations proliferate. They have a name: art advisors. These are the people who are paid to impart their taste and vision to several clients at once, and who are charged with hunting down the pieces in question, which has become an arduous task.

An additional layer in the business

Continua gallery booth at Art Basel

These intermediaries form an additional layer in the business of the consumption of current art. They are remunerated with fees fixed in advance or as a percentage of each transaction, which can go up to 10%. However, the model has its limits and the role of art advisor is one that is met with a lot of criticism today. It is not a protected designation, like a verified local product. Nor is it a role sanctioned by any kind of qualification associated with knowledge that can be flaunted, like art history. No! The art advisor declares.

Patricia Marshall

Patricia Marshall

So a number of socialites, armed with their people skills, a certain gift of the gab and a flair for sniffing out the zeitgeist, are propelled towards this job. “The new art advisors have a sense of art history that can be summed up by what they see on Instagram,” comments the French Patricia Marshall, who has been in this profession since 1991, mainly in Latin America and Los Angeles. She is well-known for having shaped the tastes of one of the biggest collectors in Mexico, Eugenio Lopez (See a report about Eugenio Lopez here), who opened his museum ten years ago. “I introduced him to American minimalism, conceptual art too. He’s my baby, in a way. What I like is to gently steer collectors towards a certain taste without them realizing it,” she declares, before adding: “The problem is that nowadays it gets abused. For example there are all these former “decoratrices” who’ve changed careers and are now asking for commissions from galleries because they’re presenting them with a buyer…”

Lisa Schiff

In recent years, the New Yorker Lisa Schiff was one of the most publicized art advisors, partly because she had a huge claim to fame: she had advised the star of the big screen, Leonardo DiCaprio. She willingly gave interviews on her quest for morality in contemporary art. She is also today facing charges of unpaid debts made by around fifty people. The affair, which has been covered by all the specialist publications, was triggered by the fact that she omitted to return 1.8 million dollars to one of her clients following the sale of a painting by sought-after Romanian painter, Adrian Ghenie. Then Schiff filed for bankruptcy. A list of works edited by the judge in charge of the case, and including names such as Barbara Kruger and Ugo Rondinone , is probably due to be auctioned off early next year, according to a professional source.

Alexandre Errera

Alexandre Errera

“The case of Lisa Schiff is worrying for the state of this profession. For the past five years or so there has been a huge amount of lying in the world of new advisors,” explains Alexandre Errera, another French national, who is based in Milan after Hong Kong, and who is primarily advising clients in Asia (See here an interview of Alexandre Errera). “We have seen them proliferating with the increasing use of social media. They falsely claim to have access to rare paintings or very confidential clients. It is an opaque and unregulated area. But the higher up you go in the scale of transactions, the fewer operators there are.” Alexandre Errera is bound by confidentiality, but agrees to say that he has sold works for up to 80 million dollars. He explains: “In Asia it is common for collectors to make an initial purchase for 5 to 10 million dollars.” (See here an interview of Alexandre Errera).

Thirst of speculation

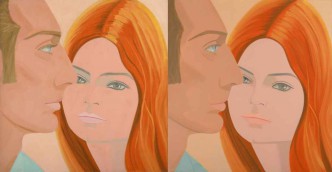

Xinyi Cheng

The gallerist Daniele Balice from the Balice Hertling gallery in Paris has been promoting various young and in-demand artists such as the Chinese artist who lives in the French capital Xinyi Cheng (born in 1989) (See here a report about Xinyi Cheng). Exhibited by the Pinault Collection and Lafayette Anticipations, among others, she is now also represented by the powerful New York gallery Matthew Marks. It has been three years since her paintings were sold by Balice Hertling for around 20,000 euros. This was the price on the primary art market. But at auction in Hong Kong, one of her canvases sold in 2022 for 532,000 euros. This shows that the thirst of speculation is now surrounding Xinyi. So advisors are buzzing around the gallery like a swarm of bees. “At the last Art Basel fair in Basel there were at least twenty presumed art consultants who came to see us to buy artworks. They put forward the names of clients who they claimed to be working with, but these weren’t factually verifiable. Now we are asking to bill the final buyer directly.”

They don’t give a shit

In a podcast on the art market, the Baer Faxt, Jeff Poe from the former Blum & Poe gallery, who is retiring after 30 years of business in Los Angeles, sums it up: “Art consultants love the art and the money. Do they love the artists? They don’t give a shit. Art dealers, successful ones, love the artist.”

Alain Tarica

This opinion is shared by a “historic” advisor to collectors. The French Alain Tarica, who is based in Switzerland, built the legendary collection of paintings belonging to Pierre Bergé and Yves Saint Laurent (1) as well as Liliane Bettencourt’s collection of paintings. “Yes, I have created collections. But the important figures in history are the people who have ‘created’ painters. They are the ones who bring the discovery of an artistic movement to the entire world,” he declares, without any false modesty.

Even André Breton

André Breton

And yet the job of advisor, which is almost as old as the idea of collecting itself, has some truly noble titles. Throughout history, more often than not the advisor would work with a single art lover – due to the egos of the powerful. We might evoke for example the encyclopédiste Denis Diderot (1713-1784) who was a major player in the vast collections of Catherine II of Russia. Closer to our times there was the American Howard Putzel (1895-1945) who guided Peggy Guggenheim in certain purchases in the late 1930s. We could also cite André Breton (1896-1966) and his involvement with couturier Jacques Doucet.

Thea Weistreich and Marc Blondeau

Marc Blondeau

But establishing an “art consultant” firm with a storefront is a recent concept. In New York in 1987 the formidable businesswoman Thea Westreich opened “Thea Westreich Art Advisory Services” in Soho and guided a whole generation of art fans. In Paris that same year, former Sotheby’s employee Marc Blondeau (see here Marc Blondeau speaking about the late dealer Thomas Ammann), who is now based in Geneva, opened an office close to the Palais de l’Elysée. “Back then there was a lack of advice directed at collectors. On the one hand the gallerists were promoting their artists, and on the other the auction houses wanted to obtain the highest prices for their sellers,” he explains. His business took off like a shot. Blondeau went on very quickly to advise film producers Jérôme Seydoux and Claude Berri, but he also introduced François Pinault to modern and then contemporary art.

Gagosian, GPS

However, with the flourishing demand for 20th-century art, everyone has started wanting a juicy piece of the art advising pie. Nowadays even the auction houses want to advise their clients while pretending not to be judge and jury. Ditto for the galleries. The powerful and legendary multinational Gagosian gallery opened a specialist service in 2019, Gagosian Art Advisory, run by Laura Paulson, formerly at Sotheby’s and Christie’s. As for the leaders of the profession, they are all based in New York. Between 2002 and 2011, one of the most impressive strike forces of its kind was GPS, which stands for Giraud, Pissarro, Ségalot, three French advisors who were hyper-connected across the Atlantic who also had the ear of Mayassa in the East, sister to the current Emir of Qatar. It was apparently GPS who sold to Qatar the painting by Paul Cézanne, “Les Joueurs de cartes” (The Card Players) for supposedly 250 or 275 million dollars. But the partnership dissolved with the departure of Franck Giraud.

Sandy Heller

Sandy Heller

For around twenty years Sandy Heller, founder of the Heller Group, has been working at the highest level of global transactions. Advisor to the New York hedge fund star Steve Cohen (founder of Point Asset Management, he is worth 19.8 billion dollars according to Forbes) and other investors such as Daniel Sundheim (founder of D1 Capital Partners, who is worth 2.9 billion dollars according to Forbes) and for a while the Russian oligarch who is now under investigation, Roman Abramovic, Sandy is reputed to work to meet every whim of his clients.

Jean-Olivier Desprès

Jean-Olivier Desprès

Ultra discretion is his other strong point. This figure with an atypical profile once studied the restoration of old masters in Italy, and his associate in Paris is Jean-Olivier Desprès, who used to be head of Gagosian in France. He has advised, among others, Nicolas Berggruen, an American businessman who is the son of Picasso’s last dealer, the French financier Edouard Carmignac, and even the owner of clothing brand Zadig and Voltaire, Thierry Gillier. “Each of these art advisors has their own specialty, their own brand,” explains a well-informed observer. Heller is capable of finding the best “trophies” in American art for his pampered clients, from Jeff Koons to Jackson Pollock.”

Tobias Meyer

Tobias Meyer

Just as confidential, there is also former Sotheby’s auctioneer, the most American of the German dandies, Tobias Meyer. In 2017, following the death of Samuel Irving Newhouse, one of New York’s legendary collectors and head of Conde Nast, he for example was appointed by the family to oversee the fate of the artworks. A small part, 16 lots, was dispersed at Christie’s on 11 May 2023, bringing in 117.7 million dollars. This great charmer has a habit of saying: “If we compare an auction house to a hospital, I am like a surgeon who’s left the establishment but who knows the best anaesthetist and the best nurse for the patient.”

Allan Schwartzman

Allan Schwartzman

Lastly, the most atypical profile among the top art advisors of the world is another American, Allan Schwartzman, who started his career modestly as a curator at the New Museum in New Yorkv(See here an interview of Allan Schwartzman about the market in 2016). Since then he has created one of the most megalomaniacal contemporary art projects on the planet: Inhotim in Brazil. It’s a sculpture park installed across 1200 hectares which hosts an ensemble of monumental artworks, from Olafur Eliasson to Matthew Barney. His commissioner is former iron ore magnate, Bernardo Paz.

Dallas and Alula

In Dallas Schartzman also shaped the collection of Howard Rachofsky, one of the great Texan art patrons, who has promised to give all his pieces to the prestigious local museum. “He was interested in the idea of collecting in unexplored fields,” reveals the very open advisor. “So we moved towards Italian and German art from the postwar period, then to Japanese art.” Rachofsky is today at the head of one of the most influential collections of contemporary art in the United States. Lastly, since 2017 Allan Schwartzman has been part of the consulting committee for the Saudi Alula site. There, he has fully let his sense of excess run wild in his contemporary art commissions. “I have created a master plan. It’s a gigantic project. The distance between certain monumental works conceived by Michael Heizer, James Turell and Lee Ufan takes around ten hours by car.” The advisor has been swept away by the story of the archaeological site built by a pre-Islamic civilization, which would be combined with current art. The works are due to start seeing the light of day in two years’ time. “I believe in the transformative power of art,” he concludes.

Filtered out

Today, there are as many forms of art advisors as types of collectors. But the market, now shaken by the current context, will have to filter out the least credible over the medium term.

Fiac

- (1)The entirety, also comprising furniture and art objects, was sold in Paris in 2009 for 373.5 million euros.

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.