Art, finance and museums

Brice Marden

In New York, the worlds of finance, contemporary art, and museums are all interlinked – but not in the way you might think. Take the example of Donald B. Marron, who died in December 2019 at the age of 85. The New York Times described him as having led some of Wall Street’s most powerful firms: he was the chairman of PaineWebber, which was bought by UBS, then he ran the private equity firm Lightyear Capital.

Old school collector

Mark Rothko

This passionate collector donated forty-odd works of modern and contemporary art to Moma in New York in 2002. In the late ’80s he even served as president of Moma, and the museum’s atrium is now named “The Donald B. and Catherine C. Marron Atrium” following one of his huge donations to expand the building. Marron was one of those “old school” collectors who bought art according to his tastes and not to make a profit. It seems he rarely sold his acquisitions.

Matthew Armstrong

Ed Ruscha

From 1995 onwards he hired Matthew Armstrong to curate his personal and professional collections, who continued to advise him until 2019. On his death, the financier’s family kept a selection of his artworks, but it was planned for the vast majority of the collection amassed since the year 2000 to be sold.

Rivalry and match

A Glimcher, B Acquavella, L Gagosian, M Glimcher

At the time, the leading auction houses competed to obtain the collection, but to no avail. So they came up with a unique solution. In February 2020, in the midst of the global pandemic, three of the biggest New York art dealers, Pace (See the interview of Arne Glimcher about Rothko here), Gagosian, and Acquavella, who are usually rivals, announced they were going to club together to buy the Marron collection comprising 300 works, and sell it on gradually. The American website Artnet, without official confirmation, values it at 450 million dollars in total. And it boasts some impressive names, from Picasso to Cy Twombly and from Matisse to Rothko. Less than a year later it seems all the major pieces have been sold.

Eclectic choices

Pablo Picasso

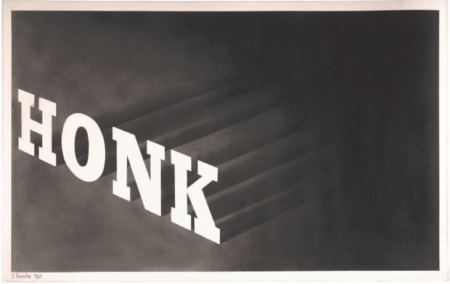

Matthew Armstrong reveals that Donald Marron’s choices were eclectic, with no limits in terms of style, themes, or chronology, from modern art to contemporary art, and he was guided by visual rather than intellectual preoccupations. “I appreciated the fact that he really knew what he liked. Art that was immediately visually striking, with very colourful elements like his pieces by Picasso, Matisse, and Richter. Paintings that were often very gestural. For the works that hung in his offices he was more inclined to take risks, with artists like Christian Marclay or Ed Ruscha.”

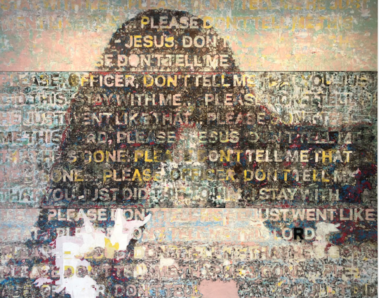

Mark Bradford

Mark Bradford

It was Matthew Armstrong who led him to discover one of the most prominent abstract artists from the new generation on the current art scene: Mark Bradford (born in 1961). He bought three of his large-scale works. Bradford, who represented the United States at the Venice Biennale in 2017 (read the report with the interview of Mark Bradford), creates abstractions on a very large scale using a unique technique with pieces of collected paper that are torn up and covered in paint, which plays with the gradations of colours. This Los Angeles native is also very involved in social initiatives with the black community in his city.

Hauser &Wirth

Represented by the powerful multinational gallery Hauser & Wirth, his works have been sold at the gallery for between around 3 and 5 million dollars and bought by numerous American institutions, such as the Hirshhorn Museum in Washington and the Lacma in Los Angeles, but the new wave of Chinese collectors have also notably supported the artist in recent times. The Fondation Louis Vuitton in Paris has two of his paintings. He is one of the new generation of American abstract painters who is always in demand, in an art market subject to upheaval and despite the current trend of growing demand for figurative works. His record price, set in 2018, is 9.7 million euros.

150 portrait tone

Mark Bradford(Lacma)

For Matthew Armstrong, “Mark Bradford’s visual language is unique. Probably the most important painting that I’ve seen in the past 10 years is his monumental ‘150 portrait tone’, which contains both abstract and figurative elements, depicting the fatal shooting of a man in 2016 by a police office in front of his partner.” But contrary to a number of European operators, Matthew Armstrong is not surprised by the prices for Mark Bradford’s works: “He has enormous cultural value.”

Jonas Wood

He also mentions the work of a figurative American painter with a vivid palette and an almost naïve streak, Jonas Wood (born in 1977), represented by Gagosian gallery. His prices have gone up to a record of 4.3 million euros in 2019. “He really knows how to express the hold that objects have over us. We bought a work that depicted his studio,” observes Matthew Armstrong, who doesn’t deny, however, that he is a fashionable artist.

Art world/ Art market

Cy Twombly

He adds:“The success of a relevant artist today is immediately linked to the market and the money this will represent. Donald Marron used to say, ‘before it was the art world and now’s it’s the art market’. He wanted to emphasise that the sums of money at stake today in the market have a corrosive effect on the art itself. Furthermore, the context of the public health crisis now makes new discoveries almost impossible. We cannot trust art that we can only see online. It’s like pre-chewed, processed food.”

Lynette Yiadom-Boakye

Lynette Yiadom-Boakye (Tate)

However, in recent months he did notice the British painter who is currently the subject of an exhibition at the Tate gallery in London, Lynette Yiadom-Boakye (born in 1977). “Right now there is a new vein of portraitists that I find very interesting. They create invented or romantic portraits.” He also mentions the Nigerian artist who lives in London, Njideka Akunyili Crosby (born in 1983).

Figuration and bright colours

This is, in effect, one of the strongest current trends in terms of international demand: highly figurative paintings in bright contrasting colours which emphasize what the figures are wearing and patterns. No doubt Lynette Yiadom-Boakye’s exhibition at the most famous museum in Britain will increase her value, which goes up to 1.3 million for a canvas depicting young girls dancing. To cite another artist appreciated by Matthew Armstrong, only ten paintings by Njideka Akunyili Crosby, who was awarded the Prix Canson in France in 2016, have gone to auction. But in 2018 one of them sold for 1.2 million euros.

Njideka Akunyili Crosby (Canson)

No prediction

What does he think the future holds for these artists subject to strong demand in the midst of a public health crisis? “I know that a number of collectors are expecting, in this period, to do a lot of business. Generally speaking, it is very difficult to predict whether purchases made in the field of contemporary art are good investments or not. Donald Marron acquired artworks very early on and for low prices which then significantly increased in value. He also liked and bought many works that have remained forgotten.”

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.