‘There was a lot of expectation and nervousness when the fair opened its doors. Sales figures at Chinese auctions have been underwhelming but the contemporary art market is establishing itself strongly in Asia.’ Its through these nuanced arguments that Marc Spiegler, director of Art Basel Hong Kong, the most important fair in Asia featuring 231 galleries, framed the general outlook during the first days of the event. He added:

François Curiel, the president of Christie’s Asia, would like to believe that the local art market remains resilient: ‘Of course, across Hong Kong the luxury market is registering noticeable falls of more than 30 per cent. It’s due to anti-corruption laws among other things. But contrary to what we read in the papers, there is still lots of liquidity in China. The art market, which is seen as being safer than a number of other investments, has been spared.’

China, the great communist empire, is juggling with its contradictions in the contemporary art market. According to Thierry Ehrmann from the art index databank Artprice, in the final six months of 2015 auction activity was down 27%. He adds, however, that ‘last year no fewer than 311 museums opened in China.’

For just under a year now the Korean art historian Yongwoo Lee ( formerly head of the respected Gwanju Biennale for 20 years) has been in charge of the private Himalayas Art Museum in Shanghai, which belongs to the Chinese businessman Dai Zhikang, ranked 314th richest person in China by Forbes in 2014. Lee explains that not only are there three private museum openings planned for next year in Shanghai but that he’s also launching a large cultural event this coming September – the Shanghai Project. A festival with exhibitions, performances, conferences, it’s a kind of public, events-based, interactive encyclopaedia financed to the tune of $6 million through private investors.

Faced with an inevitable economic recession but also a desire to belong to their time by acquiring new art, China’s wealthy are caught in two minds. Alexandre Errera, the young French private dealer, has been based in Hong Kong for four years. ‘There is a noticeable weakness in the art market,’ he explains. ‘We are no longer seeing those record-breaking transactions in the contemporary art market of a few years back involving Chinese artists from the ’90s. The Chinese are big gamblers, and that applies to art too. They’ll brutally call off all purchases from one day to the next to go and invest elsewhere’. He explains:

ArtBasel Hong Kong reflects clearly this state of play. Sales were slower than usual across the fair. Simon Lee, who owns one gallery in London and another in Hong Kong, believes that this drop in activity is an international phenomenon affecting the primary and secondary markets since last October, and represents around a 20 to 30 per cent fall. However, professionals who have invested in what for a long time appeared like a mirage of art buying in China are beginning to get out while the going is still good.

Pace Gallery, with its branches in New York and London but also Beijing and Hong Kong, sold no fewer than 19 works in the first two days of the fair – those for VIPs only – including two paintings by one of the masters of American contemporary art, Robert Rauschenberg. Among them was a 1980 work on an imposing scale (187x244cm) that went off to Asia for a rumoured $2.7 million. Robert Rauschenberg incidentally was one of the first artists to have a major exhibition in Beijing in 1995 and this June Beijing’s UCCA ( Ullens Center for Contemporary Art) will organise a show dedicated to him.

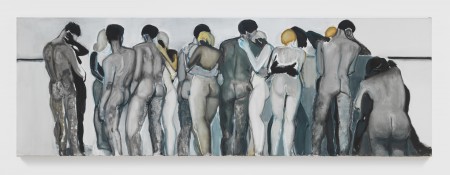

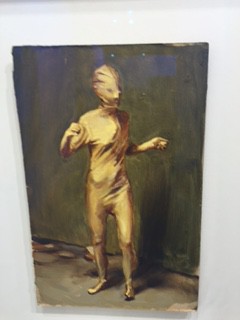

David Zwirner, the influential German dealer based in New York and London, has wagered on the Chinese taste for figurative painting as well as on the audience’s appetite for safe investments. His stand, which swarmed with Chinese from the mainland during the first day of the opening, sold an immense canvas from 1994 on the very first day of the fair (it’s 3 metres tall) by one of the current stars of painting, the South African Marlene Dumas (she benefitted from a retrospective at the Tate in London in 2015). The painting went for in excess of $3 million. It could be that LIU Yiqian and his wife Wang Wei the buyers of the Modigliani for the record price of $ 170.4 in 2015 have acquired this Dumas. At the same time Zwirner all the canvases on their booth by the Belgian artist Michael Borremans who paints sombre and mysterious characters (from $250,000 to $1.6 million).

In less than five years Chinese from the mainland and the diaspora have gone from a limited interest in local contemporary art and a speculative attitude to a deeper involvement in collecting, bolstered by significant acquisitions in art from the West.

Artbasel Hong Kong closes its doors on Saturday evening.

Donating=Supporting

Support independent news on art.

Your contribution : Make a monthly commitment to support JB Reports or a one off contribution as and when you feel like it. Choose the option that suits you best.

Need to cancel a recurring donation? Please go here.

The donation is considered to be a subscription for a fee set by the donor and for a duration also set by the donor.